The following table shows 1-year European call and put option premiums at two strike prices The continuously

Question:

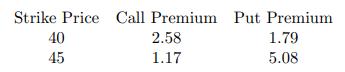

The following table shows 1-year European call and put option premiums at two strike prices

The continuously compounded risk-free interest rate is 6%.

The continuously compounded risk-free interest rate is 6%.

Describe actions you could take to construct an arbitrage strategy that results in profits at the end of one year using the above options and/or zero-coupon bonds only

Transcribed Image Text:

Strike Price Call Premium Put Premium 1.79 2.58 1.17 5.08 40 45

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 14% (7 reviews)

We begin by determining the riskfree interest rate implied by a box spread and see if i...View the full answer

Answered By

Anurag Agrawal

I am a highly enthusiastic person who likes to explain concepts in simplified language. Be it in my job role as a manager of 4 people or when I used to take classes for specially able kids at our university. I did this continuously for 3 years and my god, that was so fulfilling. Sometimes I've skipped my own classes just to teach these kids and help them get their fair share of opportunities, which they would have missed out on. This was the key driver for me during that time. But since I've joined my job I wasn't able to make time for my passion of teaching due to hectic schedules. But now I've made a commitment to teach for at least an hour a day.

I am highly proficient in school level math and science and reasonably good for college level. In addition to this I am especially interested in courses related to finance and economics. In quest to learn I recently gave the CFA level 1 in Dec 19, hopefully I'll clear it. Finger's crossed :)

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

7. Given : (i) Losses follow exponential distribution with mean 1000. (ii) There is a deductible of 500. each (i) 10 losses are expected to exceed the deductible / year. A. Determine the amount to...

-

The Hilt Company, a public relations company, signs two-year contracts with its clients. For $80,000 in advance, the company agrees to ensure that the clients name is mentioned five times on a...

-

The CAD/USD exchange rate at the beginning of the year 2015 is 1.9235. The interest rates in the year 2015 were 4.08% for Canada and 2.34% for US. Calculate the CAD/USD PPP exchange rate at the...

-

The Cooper Furniture Company of Potomac, Maryland, assembles two types of chairs (Recliners and Rockers). Separate assembly lines are used for each type of chair. Classify each cost item (AI) as...

-

Caine Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $200,000 and has an estimated useful life of 8 years with zero salvage value . Management...

-

Research articles on Online Analytic Processing (OLAP) and Online Transaction Processing (OLTP). Next, compare and contrast the key similarities and differences between Online Analytical Processing...

-

Assume the same underlying stock, same time to expiration, and same strike price for all derivatives in this problem. Which of the following must have the same profit as a floor coupled with a...

-

CornGrower is going to sell corn in one year. In order to lock in a fixed selling price, CornGrower buys a put option and sells a call option on each bushel, each with the same strike price and the...

-

What is a coordination mechanism? Give an example.

-

Explain why, in a free-body diagram, the lengths of the arrows representing the forces exerted on an apple at rest in your hand should be equal.

-

A toy car rolls along a track, starting at the top of a ramp, then rolling down to floor level. After reaching the floor, the track contains a circular loop-the-loop with a diameter of 60 cm...

-

If all the values are approximate numbers, solve to the correct number of significant digits: 342.5-341.1 3.045*0.04203

-

The sketch is a cross section through the earth, showing two points that have a difference in latitude of angle 0. The mean radius R of the earth is 6.371 106 meters. A nautical mile is defined as...

-

1. 1a. A ball vertically drops from rest onto a flat surface a distance 3.0\,\mathrm{m}3.0m below the ball. After bouncing once, it returns to its original height. You may assume that the time of the...

-

Claus Enterprises has 174,000 shares of common stock outstanding at a current price of $46 a share. The firm also has two bond issues outstanding. The first bond issue has a total face value of...

-

Determine by direct integration the values of x for the two volumes obtained by passing a vertical cutting plane through the given shape of Fig. 5.21. The cutting plane is parallel to the base of the...

-

Fence posts for a particular job cost $10.50 each to install, including the labor cost. They will last 10 years. If the posts are treated with a wood preservative they can be expected to have a...

-

A piece of property is purchased for $10,000 and yields a $1000 yearly net profit. The property is sold after 5 years. What is its minimum price to breakeven with interest at 1O%?

-

Rental equipment is for sale for $110,000. A prospective buyer estimates he would keep the equipment for 12 years and spend $6000 a year on maintaining the equipment. Estimated annual net receipts...

-

Simian Valley Corp. owns both the land and building that it uses for a banana plantation. The original cost of the building was $412,500 and had a book value of $225,000 at January 1, 2023. On this...

-

Your company produces 700,000 widgets per year but has the capacity to produce 950,000 units. Company records show the following; full product costs = $85 per unit, which includes fixed manufacturing...

-

How does the rendering of services on account affect the accounting equation? How does paying a liability in cash affect the accounting equation? How does the payment of dividends affect the...

Study smarter with the SolutionInn App