Two actuaries, A and B, use a two-period binomial forward tree to compute the prices of a

Question:

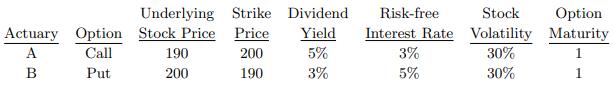

Two actuaries, A and B, use a two-period binomial forward tree to compute the prices of a European call and a European put using different parameters.

You are given:

Describe the relationship between the call price computed by Actuary A and the put price computed by Actuary B.

Transcribed Image Text:

Actuary Option A Call B Put Underlying Strike Stock Price Price 200 190 190 200 Dividend Risk-free Stock Yield Interest Rate Volatility 5% 30% 3% 30% 3% 5% Option Maturity 1 1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

The relationship between the call price computed by Actuary A and the put price computed by Actuary ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

E-levy and elasticity of demand for electronic transaction services. Consider the following facts about mobile money transactions. Currently, MTN and AirtelTigo charge 1% on mobile money transactions...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The price of a stock is $40. A six-month European call option on the stock with a strike price of $30 has an implied volatility of 35%. A six month European call option on the stock with a strike...

-

A quality of information demonstrated when different independent observers could reach the same general conclusions that the information represents what it purports to represent is: O a...

-

What is a pension plan settlement? Curtailment? How should the net gain or loss from a settlement or curtailment be accounted for by a company according to FASB Statement No. 88?

-

Why are lawyers and technology experts warning companies to store, organize, and manage computer data, including e-mail and instant messages, with sharper diligence?

-

On April 4, 2014, Athanasios Valsamis lost his appeal to get his money back from a friend to whom he had loaned \($700,000.\) As you will read, this case underscores the consequence of failing to...

-

The following are the financial statements of Nosker Company. Additional data: 1. Dividends declared and paid were $20,000. 2. During the year equipment was sold for $8,500 cash. This equipment cost...

-

While many parties were interested in acquiring MCI, the major players included Verizon and Qwest. U.S.-based Qwest is an integrated communications company that provides data, multimedia, and...

-

The graph below illustrates a market for cigarettes. Use it to answer the questions that follow. a. Based only on the graph, are there positive or negative externalities associated with cigarettes?...

-

You want to be a millionaire when youretire in 40 years. How much do you have to save each month if you can earn anannual return of 10.5 percent? How much do you have to save each month if you wait10...

-

Ethers tend to dissolve in alcohols and vice versa. Represent the hydrogen-bonding interaction between an alcohol molecule and an ether molecule.

-

2 A+3B--> 4 D substance AHO (kJ/mol) Calculate the AHf of B. AHrxn = 250 kJ A -436.5 D -810.0

-

What shape does cyclopropane, cyclobutane, cylopentane, and cyclohexane resemble? 5.) How would you describe naming alkanes with substituents? 6.) What is the difference between line angle formula...

-

AHrxn = -839 kJ What minimum grams of 12 (253.808 g/mol) is needed to heat 3.872 kg of water from 20.0 C to 80.0 C? The specific heat of water is 4.18 J/g C. 2 Ti(s) + 3 1(s) -- --> 2 Til3(s).

-

Refer to your Lewis structure for SeCl What is the "electron pair" geometry for selenium dichloride? bent O linear tetrahedral square planar trigonal planar

-

47) Show the best Williamson ether synthesis for the following target molecule. Answer: Br NaO

-

Can a charitable organization exempt under section g 501(c)(3), not a private foundation, file a group return for all of its branches if they are located in different states?

-

Fill in each blank so that the resulting statement is true. A solution to a system of linear equations in two variables is an ordered pair that__________ .

-

What is the primary distinction between financial accounting and managerial accounting?

-

Describe the relatioliship among the accounting process, accounting information, decision makers, and economic activities.

-

What are some examples of nonfinancial information that is often used by management in performing its duties?

-

Newton Company issued its $1,000,000, 7%, ten-year bonds to the public on January 1, 2016. The bonds pay interest annually, beginning on December 31, 2016. Newton Company received $1,154,420 in cash...

-

Jeannie, a single taxpayer, retired during the year, to take over the management of some rental property. She had the following items of income and expense: Salary prior to retirement date $34,000...

-

Consider the following information: Rate of return State of Economy Probability Stock A Stock B Recession 0.30 -40% 6% Normal Boom 0.50 18% 4% 0.20 142% 2% [Note: take full decimal places in the...

Study smarter with the SolutionInn App