You are given: (i) The following 1-year European put option prices on the same stock: (ii) The

Question:

You are given:

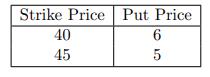

(i) The following 1-year European put option prices on the same stock:

(ii) The continuously compounded risk-free interest rate is 6%.

You take advantage of any possible mispricing by means of an appropriate spread position.

Calculate your 1-year profit when the 1-year stock price is 42.

Transcribed Image Text:

Strike Price 40 45 Put Price 6 65 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Since P40 P45 the increasing monotonicity of put prices i...View the full answer

Answered By

Joseph Njoroge

I am a professional tutor with more than six years of experience. I have helped thousands of students to achieve their academic goals. My primary objectives as a tutor is to ensure that students do not have problems while tackling their academic problems.

4.90+

10+ Reviews

27+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the two ellipses in the x y plane given by the equations (a) Use the ezplot command to plot the two ellipses in the same figure. (b) Determine the coordinates of the points where the...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

The simple truss shown has the following dimensions: H1 = 1.90 in; H2 = 1.60 in; L0=31 in; L2 = 14 in; D1 = 0.76 in; D2 = 0.86 in. Both supporting bars have a depth of 0.5 in. If the maximum...

-

Using the high-low method and the following information, compute the monthly variable cost per telephone hour and total fixed costs for Sadiko Corporation. Telephone Telephone Costs Month April May...

-

Income statement data for Starr Canning Corporation are as follows: Required a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales (vertical...

-

Consider the following cash flow profile and assume MARR is 10 percent/year. a. What does Descartes' rule of signs tell us about the IRR(s) of this project? b. What does Norstrom's criterion tell us...

-

Governmental Hospital. During 2011, the following selected events and transactions were recorded by Nichols County Hospital. 1. Gross charges for hospital services, all charged to accounts and notes...

-

Our company makes school buses. Here is some data on the cost of producing these vehicles. Monthly Production Data Output 0 1 2 3 4 5 6 7 8 9 10 Total cost 200,000 400,000 575,000 725,000 850,000...

-

Explain intuitively when you will expect that C E F P 0,T (S).

-

You are given the following: The current price to buy one share of XYZ stock is 500. The stock does not pay dividends. The annual risk-free interest rate, compounded continuously, is 6%. A...

-

Use any method to evaluate the derivative of the following functions. 2z f(z) = z(e% + 4) - z* + 1 ,3z .2

-

. In the following macroeconomic system, find the parametric solutions for the predicted GDP ( Y ) and for the predicted investment ( I ). Y = C + I + G 0 C = a + b ( Y T 0 ) I = e + k Y

-

Based on the 1993 Revenue code of quezon city, can a business selling raw materials to manufacturers be classifed as wholesale business?

-

How is it possible for the US to have a higher per capita GDP than Japan or Italy while having only slightly fewer hours of free time per year? Labor productivity (output per hour of work) must be...

-

Emmy lou runs a woolen mill and her business is doing well enough that she would like to start a qualified retirement plan for her employees. after establishing the plan, she can begin transferring...

-

What is blockchain technology? What is the essence of cryptocurrency scams. Discuss the Digital Forensics Process: Analyze any challenges and controversies associated with cryptocurrency scams.

-

Why are interest rate swap markets useful and should there be more government oversight or less and why?

-

A city maintains a solid waste landfill that was 12 percent filled at the end of Year 1 and 26 percent filled at the end of Year 2. During those periods, the government estimated that total closure...

-

The manager in a canned food processing plant is trying to decide between two labeling machines. Their respective costs and benefits are as follows: Assume an interest rate of 12%. Use annual cash...

-

Carp, Inc. wants to evaluate two methods of shipping their products. The following cash flows are associated with the alternatives: Use an interest rate of 15% and annual cash flow analysis to decide...

-

A college student has been looking for a new tire for his car and has located the following alternatives: The student feels that the warranty period is a good estimate of the tire life and that a 10%...

-

Given the following Income Statement Information: Consolidated Income Statement - USD ($) $ in Millions Operating Revenue: $ 18,827 Cost of Revenue: $ 8,405 General & Admin: $1,831 Selling Expense:...

-

Total (gross) revenues per month $ 27,000 less explicit costs: Cost of merchandise sold $ 17,000 Wages to cashier, stock, and delivery help 2,500 Rent and utilities 800 Taxes 700 Total explicit costs...

-

Utility costs at one of Hannemann Corporation's factories are listed below: Machine-Hours Utility Cost March 5,021 $52,824 April 5,076 $53,287 May 5,074 $53,263 June 5,040 $52,991 July 5,087 $53,371...

Study smarter with the SolutionInn App