A stock is currenly trading at 80. There are one-month calls and puts on the stock with

Question:

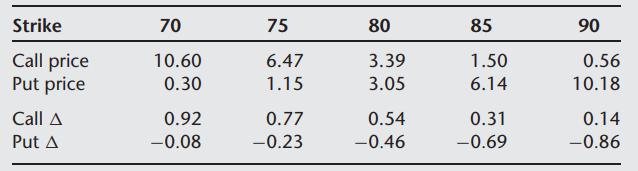

A stock is currenly trading at 80. There are one-month calls and puts on the stock with strike prices of 70, 75, 80, 85, and 90. The price and delta of each of these options are given below:

For each of the following portfolios, identify (i) the current value of the portfolio, and (ii) the approximate value of the portfolio following a $1 decrease in the stock price.

(a) Long 100 units of stock, short 100 units of the 80-strike call.

(b) Long 1000 units of the 80-strike call and 1174 units of the 80-strike put.

(c) Long 100 units of stock, long 100 units of the 75-strike put, and short 100 units of the 85-strike call.

(d) Long 100 units of the 70-strike call, long 100 units of the 90-strike call, and short 200 units of the 80-strike call.

(e) Long 100 units of the 85-strike put and short 100 units of the 75-strike put.

Step by Step Answer: