Major investor IwanItall has a portfolio of 100 million USD two-year semiannual floating-rate notes, based on six-month

Question:

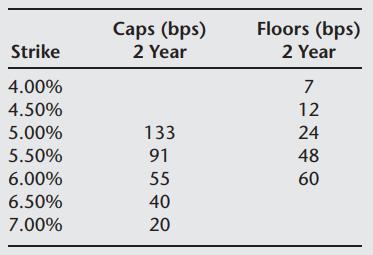

Major investor IwanItall has a portfolio of 100 million USD two-year semiannual floating-rate notes, based on six-month Libor. This is a standard floating-rate note with coupons being set every six months. He wants to ensure that he receives a minimum Libor yield of 6.00% in the future. The current market quotes (one-time premiums defined in basis points of the face value of the option) for caps and floors on six-month Libor as are follows:

For example the two-year cap at 6.50% costs 40 basis points up front, i.e., 20 basis points per annum.

(a) What option should Iwan Itall purchase to ensure that his gross yield (before the cost of the option) does not drop below 6.00% per annum? Depict his gross payoffs per coupon payment (before options costs) and net payoffs (after options costs) on suitable diagrams. Label the diagrams correctly. Make use of the simplifying assumption in the note above.

(b) If you think the options cost of the strategy in (a) above is too high, what would you advise Iwan to do to subsidize the cost? Iwan has told you that he is willing to bear the risk that Libor will not cross 7.00%. Once again, provide the appropriate payoff diagrams.

(c) Can you help Iwan devise a zero-cost options strategy such that he can meet his objective of a minimum gross per annum yield of 6.00%?

(d) From the information provided, what is the approximate two-year fixed rate of interest?

Step by Step Answer: