If people have different costs of default, such that for each person there is a threshold repayment

Question:

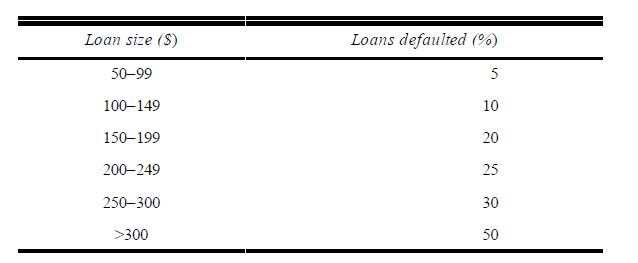

If people have different costs of default, such that for each person there is a threshold repayment burden that they will always want to default upon, explain why loans above a certain size will never be offered by any lender, even with very high-risk premiums built into the rate of interest. Use graphs to explain your answer. Here is a special example that builds on the preceding general question. The following table gives default risks for various loan sizes in an informal credit market.

Suppose that the rate of interest in the informal sector is 18% per year and that in the formal sector (with no default) is 10% per year. Calculate the maximum loan size that will be offered in the informal-sector credit market. For what minimum rate of interest will loans in the $250–300 category be offered? (This example is more special than the general question in the first paragraph, because the default rates may also depend on the rate of interest being charged, and this is not taken into account in the example. How would you try to amend the example so that it fits the more general scenario?)

Step by Step Answer: