The Index of Industrial Production (left(I P_{t} ight)) is a monthly time series that measures the quantity

Question:

The Index of Industrial Production \(\left(I P_{t}\right)\) is a monthly time series that measures the quantity of industrial commodities produced in a given month. This problem uses data on this index for the United States. All regressions are estimated over the sample period 1986:M1-2017:M12 (that is, January 1986 through December 2017). Let \(Y_{t}=1200 \times \ln \left(I P_{t} / I P_{t-1}\right)\).

a. A forecaster states that \(Y_{t}\) shows the monthly percentage change in \(I P\), measured in percentage points per annum. Is this correct? Why?

b. Suppose she estimates the following AR(4) model for \(Y_{t}\) :

\[ \begin{gathered} \hat{Y}_{t}=0.749+0.071 Y_{t-1}+0.170 Y_{t-2}+0.216 Y_{t-3}+0.167 Y_{t-4} \\ (0.488)(0.088)(0.053) \quad(0.078) \end{gathered} \]

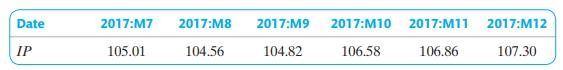

Use this AR(4) to forecast the value of \(Y_{t}\) in January 2018, using the following values of IP for July 2017 through December 2017:

c. Worried about potential seasonal fluctuations in production, she adds \(Y_{t-12}\) to the autoregression. The estimated coefficient on \(Y_{t-12}\) is -0.061 , with a standard error of 0.043 . Is this coefficient statistically significant?

d. Worried about a potential break, she computes a QLR test (with \(15 \%\) trimming) on the constant and AR coefficients in the AR(4) model. The resulting QLR statistic is 1.80. Is there evidence of a break? Explain.

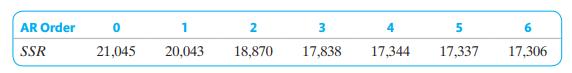

e. Worried that she might have included too few or too many lags in the model, the forecaster estimates \(\operatorname{AR}(p)\) models for \(p=0,1, \ldots, 6\) over the same sample period. The sum of squared residuals from each of these estimated models is shown in the table. Use the BIC to estimate the number of lags that should be included in the autoregression. Do the results differ if you use the AIC?

Step by Step Answer: