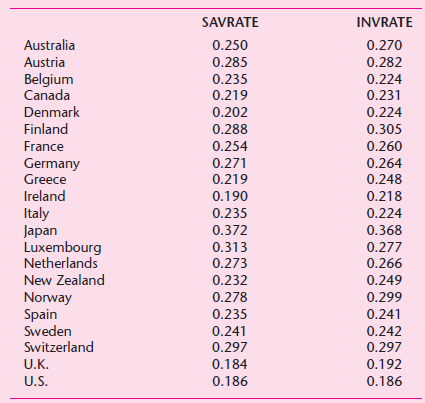

To study the relationship between investment rate (investment expenditure as a ratio of the GDP) and savings

Question:

The investment rate for each country is the average rate for the period 1960€“1974 and the savings rate is the average savings rate for the period 1960 1974. The variable Invrate represents the investment rate and the variable Savrate represents the savings rate.

a. Plot the investment rate against the savings rate.

b. Based on this plot, do you think the following models might fit the data equally well?

Invratei = β1 + β2Savratei + ui

ln Invratei = α1 + α2 ln Savratei + ui

c. Estimate both of these models and obtain the usual statistics.

d. How would you interpret the slope coefficient in the linear model? In the log linear model? Is there a difference in the interpretation of these coefficients?

e. How would you interpret the intercepts in the two models? Is there a difference in your interpretation?

f. Would you compare the two r 2 coefficients? Why or why not?

g. Suppose you want to compute the elasticity of the investment rate with respect to the savings rate. How would you obtain this elasticity for the linear model? For the log€“linear model? Note that this elasticity is defined as the percentage change in the investment rate for a percentage change in the savings rate.

h. Given the results of the two regression models, which model would you prefer? Why?

Step by Step Answer: