An investment alternative requires an initial investment of ($ 19,000) and has a life of 6 years.

Question:

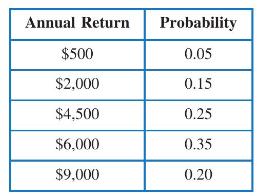

An investment alternative requires an initial investment of \(\$ 19,000\) and has a life of 6 years. The annual returns for the investment are independent and defined by the discrete probability distribution shown in the table below.

For the following question, determine an analytical solution using a MARR of \(20 \%\) :

a. Determine the analytical expected value of present worth.

For the following questions, determine a simulation solution using @RISK:

b. Use Latin hypercube simulation with 25 trials to generate an estimate of the expected present value and the probability that the present worth will be less than 0 .

c. Use Latin hypercube simulation with 100,000 trials to generate an estimate of the expected present value and the probability that the present worth will be less than 0 .

d. Use Monte Carlo simulation with 25 trials to generate an estimate of the expected present value and the probability that the present worth will be less than 0 .

e. Use Monte Carlo simulation with 100,000 trials to generate an estimate of the expected present value and the probability that the present worth will be less than 0 .

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt