Consider an investment decision problem with two decision points. At the first decision point, the investor can

Question:

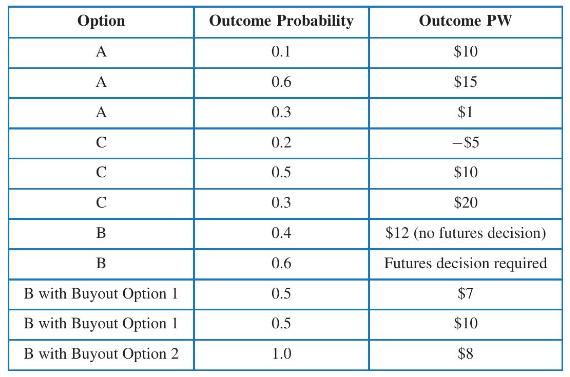

Consider an investment decision problem with two decision points. At the first decision point, the investor can select between Options A, B, or C, each of which has an uncertain outcome with the probabilities and present worths shown in the table below. If Option B is selected, there is a 60 percent chance that, before the termination of the investment, a futures contract will be triggered that will require the selection of Buyout Option 1 or Buyout Option 2. The probabilities and present worths associated with these buyout options are also shown in the table.

a. Draw a decision tree to represent this situation.

b. Determine what decisions should be made.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt