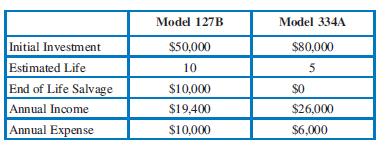

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven

Question:

Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 8 percent/year.

a. What is the discounted payback period for each investment?

b. Which oven should Octavia Bakery purchase if they wish to minimize the DPBP?

c. Is this recommendation consistent with a present worth analysis recommendation in Problem 28?

Data from Problem 28

Final Finishing is considering three mutually exclusive alternatives for a new polisher. Each alternative has an expected life of 10 years and no salvage value. Polisher 1 requires an initial investment of \($20\),000 and provides annual benefits of \($4\),465. Polisher 2 requires an initial investment of \($10\),000 and provides annual benefits of \($1\),770. Polisher 3 requires an initial investment of \($15\),000 and provides annual benefits of \($3\),580. MARR is 15 percent/year.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt