Investment is measured in the national income accounts as the sum of spending on physical capital

Question:

Investment is measured in the national income accounts as the sum of spending on physical capital – plants and equipment, infrastructure, and housing – and changes in inventories of produced goods. Using this definition, the portion of U.S. real GDP allocated to investment lags behind much of the rest of the developed world. Some economists worry that the result is that total planned expenditures are depressed along with equilibrium income. In addition, these economists are concerned that the lower rate of investment reduces the rate of capital accumulation and reduces economic growth.

Other economists believe that the current definition of investment fails to capture the true meaning of the term. Most of measured investment spending looks at capital, resources used to produce output in the future. There are at least three other types of expenditures that appear to fit this definition, which are not currently included in investment. The first is education, which yields returns over long periods of time. Much of educational spending is investment in human capital. Currently, only spending on schools and educational equipment are included in investment spending. The U.S. allocates nearly 7 percent of real GDP to education. Most other countries allocate 5.5 percent or less to education. Second is spending on research and development (R&D). R&D expenditures are counted as government consumption and private production costs. R&D expenditures aid economic growth. The U.S. allocates about 3 percent of real GDP to R&D, while most other countries allocate 2 percent or less. Finally, consumer durables yield a stream of services over several years, yet only housing is counted as investment in the national income accounts. U.S. households spend about 6 percent of real GDP for other durables that yield service flows for years.

Another factor in comparing the U.S. investment rate with that of other countries is that U.S. investment goods are less expensive. That is, a given dollar of spending on factories or equipment provides more units of these goods in the U.S. as compared to other countries.

When all these factors are considered, the adjusted measure of investment of the U.S. exceeds 35 percent per year, while the average rate adjusted the same way for other industrialized countries is only about 30 percent.

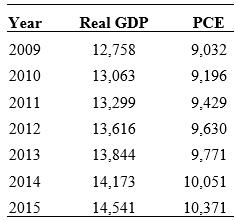

A significant issue from 2009 to 2012 was the problem of slow economic growth after the recession that began in late 2007. An important problem was predicting what would “get the economy growing” fast enough to get out of a “jobless recovery.” Part of the issue could be viewed as the amount of new spending that would be needed. The multiplier concept can be in determining the answer to this problem. The multiplier suggests that the MPC, and thus the multiplier, is constant over time, so that the size of a given change in autonomous spending will have a predictable effect on equilibrium real GDP. According to the national income and product tables given by the Bureau of Economic Analysis, real GDP and personal consumption expenditures (PCE) in billions of 2005 dollars for the years 2009–2012 are:

Use these figures to determine the simple multiplier to predict how changes in autonomous spending will affect real GDP.

Step by Step Answer: