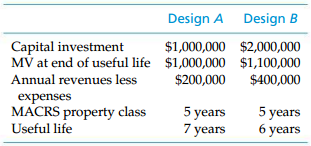

A firm must decide between two silicon layer chip designs from Intel. Their effective income tax rate

Question:

Transcribed Image Text:

Design A Design B Capital investment MV at end of useful life $1,000,000 $2,000,000 $1,000,000 $1,100,000 $200,000 Annual revenues less $400,000 expenses MACRS property class Useful life 5 years 7 years 5 years 6 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 69% (13 reviews)

Assume repeatability and compare AW over useful life Design A Design B Select Design A ...View the full answer

Answered By

Mwangi Clement

I am a tried and tested custom essay writer with over five years of excellent essay writing. In my years as a custom essay writer, I have completed more than 2,000 custom essays in a diverse set of subjects. When you order essays from me, you are working with one of the best paper writers on the web. One of the most common questions I get from customers is: “can you write my essay?” Upon hearing that request, my goal is to provide the best essays and overall essay help available on the web. I have worked on papers in subjects such as Nursing and Healthcare, English Literature, Sociology, Philosophy, Psychology, Education, Religious Studies, Business, Biological Sciences, Communications and Media, Physical Sciences, Marketing and many others. In these fields, my specialties lie in crafting professional standard custom writings. These include, but are not limited to: research papers, coursework, assignments, term papers, capstone papers, reviews, summaries, critiques, proofreading and editing, and any other college essays.

My extensive custom writings experience has equipped me with a set of skills, research abilities and a broad knowledge base that allows me to navigate diverse paper requirements while keeping my promise of quality. Furthermore, I have also garnered excellent mastery of paper formatting, grammar, and other relevant elements. When a customer asks me to write their essay, I will do my best to provide the best essay writing service possible. I have satisfactorily offered my essay writing services for High School, Diploma, Bachelors, Masters and Ph.D. clients.

I believe quality, affordability, flexibility, and punctuality are the principal reasons as to why I have risen among the best writers on this platform. I deliver 100% original papers that pass all plagiarism check tests (Turnitin, Copyscape, etc.). My rates for all papers are relatively affordable to ensure my clients get quality essay writing services at reasonable prices.

4.50+

5+ Reviews

14+ Question Solved

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted:

Students also viewed these Business questions

-

A firm must decide between constructing a new facility or renting a comparable office space. There are two random outcomes for acquiring space, as shown in Figure PI 2-25. Each would accommodate the...

-

An investor must decide between two alternative investmentsstocks and bonds. The return for each investment, given two future economic conditions, is shown in the following payoff table: What...

-

An analyst must decide between two different forecasting techniques for weekly sales of roller blades: a linear trend equation and the naive approach. The linear trend equation is Ft = 124 + 2 t, and...

-

Hot Locks Company developed the following information for its hair dryer sales: Sales price $ 125.00 per unit Variable manufacturing cost $ 44.75 per unit Variable selling expense ...

-

Hickock Mining is evaluating when to open a gold mine. The mine has 44,000 ounces of gold left that can be mined, and mining operations will produce 5,500 ounces per year. The required return on the...

-

In Problem use the pricedemand equation to find E(p), the elasticity of demand. x = f(p) = 10,000 - 190p

-

A tennis ball is a rubber hollow sphere covered by a thin layer of fabric usually yellow in color. It has a diameter of \(6.54-6.86 \mathrm{~cm}\) and weighs \(56.0-59.4 \mathrm{~g}\). The internal...

-

J. Ortiz Wholesale Corp. uses the LIFO method of inventory costing. In the current year, profit at B. J. Ortiz is running unusually high. The corporate tax rate is also high this year, but it is...

-

A currenty situation I'm in is buying new furniture and appliances for my new home, its a constant struggle balancing what I want and how much it costs. A linear way of making this decision is by...

-

Irwin, Inc. constructed a machine at a total cost of $25 million. Construction was completed at the end of 2017 and the machine was placed in service at the beginning of 2018. The machine was being...

-

Alternative Methods I and II are proposed for a security operation. The following is comparative information: Determine which is the better alternative based on an after-tax annual cost analysis with...

-

The expected annual maintenance expense for a new piece of equipment is $10,000. This is Alternative A. Alternatively, it is possible to perform the maintenance every fifth year at a cost of $50,000...

-

Future and present value of an annuity Use equations 5.3 and 5.4 to find the future and present value of a five-year ordinary annuity paying $100 per year at each of the following interest rates: a....

-

Provide a static method that reverses the elements of a generic array list.

-

Implement the animal guessing game described in Section 17.2.1. Start with the tree in Figure 4, but present the leaves as Is it a(n) X? If it wasnt, ask the user what the animal was, and ask for a...

-

Enhance Exercise Graphics P22.8 so that it shows two frames, one for a merge sorter and one for a selection sorter. They should both sort arrays with the same values. Data from exercise graphics...

-

When a socket is created, which of the following Internet addresses is used? a. The address of the computer to which you want to connect b. The address of your computer c. The address of your ISP

-

Write a program to determine how many actors there are in the data set in Worked Example 19.2. Note that many actors are in multiple movies. The challenge in this assignment is that each movie has a...

-

1. What environmental issues does the New Belgium Brewing Company work to address? How has NBB taken a strategic approach to addressing these issues? Why do you think the company has taken such a...

-

A Alkynes can be made by dehydrohalogenation of vinylic halides in a reaction that is essentially an E2 process. In studying the stereochemistry of this elimination, it was found that...

-

A manufacturer of off-road vehicles is considering the purchase of dual-axis inclinometers for installation in a new line of tractors. The distributor of the inclinometers is temporarily overstocked...

-

The Moller Skycar M400 is a flying car known as a personal air vehicle (PAV) that is expected to be FAA-certified by December 31, 2011. The cost is $985,000, and a $100,000 deposit will hold one of...

-

A family that won a $100,000 prize on America's Funniest Home Videos decided to put one-half of the money in a college fund for their child who was responsible for the prize. If the fund earned...

-

How is decision-making in organizations best supported by Management Accounting (a descriptive nature) and how should it be supported by Management Accounting (a prescriptive nature)? Is there a gap...

-

Discuss the thermodynamic principles governing the separation of azeotropic mixtures using advanced distillation techniques such as pressure swing distillation, extractive distillation, and hybrid...

-

respond to the discussion In the IMA article, Activity-Based Costing (ABC) is explained as a cost allocation technique that traces indirect costs (often referred to as "overhead") to specific cost...

Study smarter with the SolutionInn App