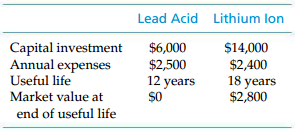

Consider the following EOY cash flows for two mutually exclusive alternatives (one must be chosen): The MARR

Question:

The MARR is 5% per year.

a. Determine which alternative should be selected if the repeatability assumption applies.

b. Determine which alternative should be selected if the analysis period is 18 years, the repeatability assumption doesnotapply, and a battery system can be leased for $8,000 per year after the useful life of either battery is over.

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted: