Gillian has developed estimates for strengthening the undercarriage on a medium-use, 70-year-old bridge for which there is

Question:

(a) Determine what the project will cost in PW terms.

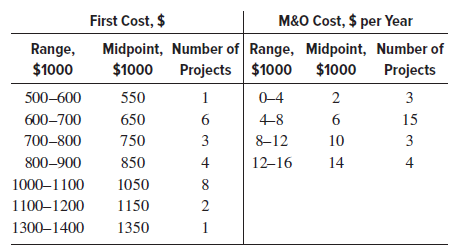

(b) During the analysis, Gillian learned that some 25 similar projects had been completed over the last 10 years. With the help of her supervisor, Gillian obtained the information below on the first cost, P, and maintenance cost, M&O, for these projects. Repeat the PW evaluation using expected values for these two estimates. Is PW higher or lower than the value in part (a)?

(c) Assume the bridge is strengthened and administratively moved to the toll division, which promises a net revenue of $180,000 per year above the M&O cost. Is the project economically justified at the first cost of $800,000? What is the projected response from the driving public to the toll on this 70-year-old bridge?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Step by Step Answer: