Kleen Corp., a privately owned and operated single-stream recycling facility, has annual contracts with several cities in

Question:

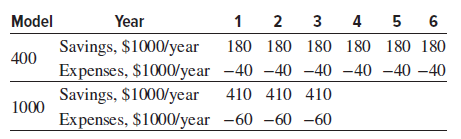

(a) Perform an ROR analysis using MARR = 5% per year to recommend one of the two models to your president. You know that your president likes dollar-per-year figures, and will want to see a plot of the annual worth amounts for different rate of return values when you visit with her.

(b) Before you finalize your recommendation, ensure that there is no ranking inconsistency present with these two alternatives. If there is not, no problem. If there is, be prepared to provide the logic of your recommendation.

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: