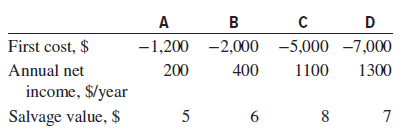

You wish to evaluate four independent projects that all have a 10-year life at MARR = 15%

Question:

(a) Accept or reject each project using a present worth analysis. On your spreadsheet, include the logical IF function to make the accept/reject decision.

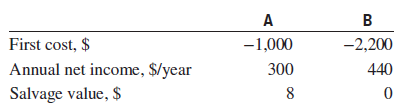

(b) The preliminary estimates have changed for projects A and B as shown below. Use the same spreadsheet to reevaluate them.

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: