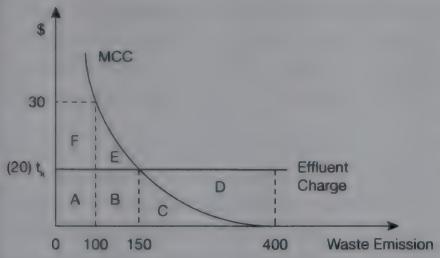

Refer back to Figure 5.3. Let t k now represent, not effluent tax, but subsidies. In other

Question:

Refer back to Figure 5.3. Let tk now represent, not effluent tax, but subsidies. In other words, the firm will be paid by the regulators t, (i.e., $20) for each unit of waste cleaned up.

(a) Demonstrate that the final outcome will be the same (cleanup 250 units of waste or control 150 units of waste) regardless whether the firm is charged tax or paid a subsidy.

(b) If the firm is paid a subsidy, it stands to earn a net gain of area D in Figure 5.3, and the government loss will be area A +B in terms of tax receipt.

(c) If the above outcomes are true, what does it suggest about a ‘cost-effective’ outcome of pollution control in terms of income distribution and fairness?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Environmental Economics And Sustainability

ISBN: 9780415676915

3rd Edition

Authors: Ahmed Hussen

Question Posted: