Amy Tanner is an analyst for a U.S. pension fund. Her supervisor has asked her to value

Question:

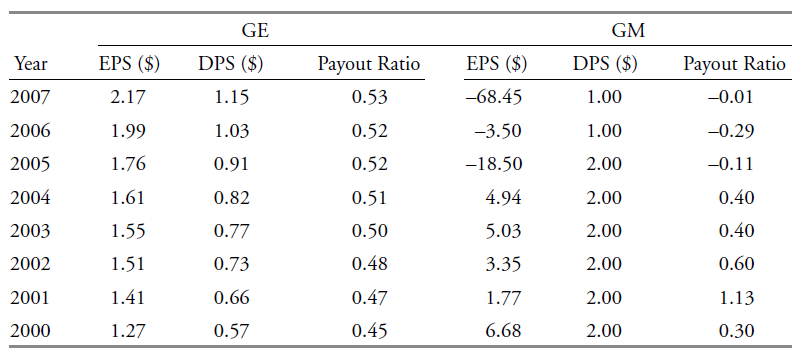

For each of the stocks, explain whether the DDM is appropriate for valuing the stock.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

Question Posted: