As of late 2013, few sectors had a wider range of P/B ratios than the US banking

Question:

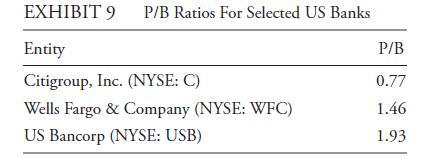

As of late 2013, few sectors had a wider range of P/B ratios than the US banking industry. Much of these differences in P/B ratios can be attributed to differences in company-specific business models. Exhibit 9 presents P/B ratios for three major US banks as of 13 September 2013.

Citigroup’s low P/B versus its peers is a reflection of the troubled “one-stop shopping”

business model it and some other mega-banks pursued in the 1990s. Citigroup suffered huge losses during the global financial crisis and had to be rescued in November 2008 by the US government.

Wells Fargo derives most of its revenue from loans and service fees. Its business model focuses on cross-selling multiple products, and in 2012 it was responsible for originating close to a third of all US home loans. Wells Fargo is also predominantly a domestic business, whereas other large banks are much more exposed to overseas markets.

US Bancorp’s relatively risk-averse business model is focused on consumer and business banking as well as trusts and payment processing. Compared with other mega-

banks, US Bancorp has a much smaller presence in investment banking and capital markets. Another reason for the bank’s relatively high P/B was its acquisition activity, which has helped it grow its business considerably since the economic downturn.

Step by Step Answer: