Bugg Properties expected EPS is ($2.00) ($2.50) and ($4.00) for the next three years. Analysts expect that

Question:

Bugg Properties’ expected EPS is \($2.00\) \($2.50\) and \($4.00\) for the next three years.

Analysts expect that Bugg will pay dividends of \($1.00\) \($1.25\) and \($12.25\) for the three years. The last dividend is anticipated to be a liquidating dividend; analysts expect Bugg will cease operations after Year 3. Bugg’s current book value is \($6.00\) per share, and its required rate of return on equity is 10 percent.

i. Calculate per-share book value and residual income for the next three years.

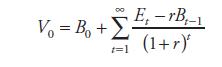

ii. Estimate the stock’s value using the residual income model given in Equation 3.

iii. Confirm your valuation estimate in Part 2 using the discounted dividend approach

iii. Confirm your valuation estimate in Part 2 using the discounted dividend approach

(i.e., estimating the value of a share as the present value of expected future dividends).

Step by Step Answer: