Continuing with the valuation of telecommunication service providers, you gather information on selected fundamentals related to risk

Question:

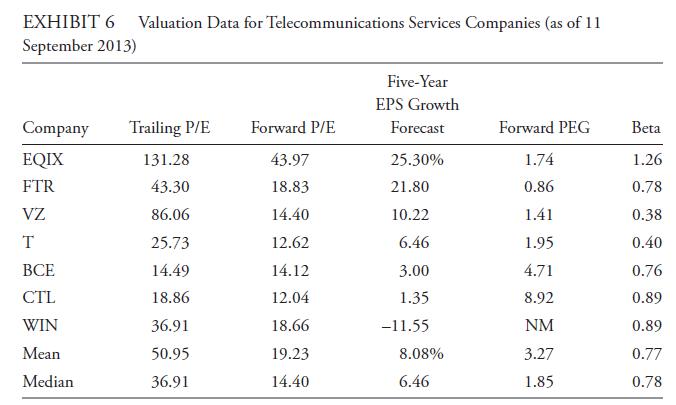

Continuing with the valuation of telecommunication service providers, you gather information on selected fundamentals related to risk (beta), profitability (five-year earnings growth forecast), and valuation (trailing and forward P/Es).26 These data are reported in Exhibit 6, which lists companies in order of descending earnings growth forecast. The use of forward P/Es recognizes that differences in trailing P/Es could be the result of transitory effects on earnings.

Based on the data in Exhibit 6, answer the following questions:

i. In Example 10, Part 3, T, BCE, and CTL were identified as possibly relatively undervalued compared with the peer group as a whole, and WIN was identified as relatively fairly valued. What does the additional information in Exhibit 6 relating to profitability and risk suggest about the relative valuation of these stocks?

ii. T has a consensus year-ahead EPS forecast of \($2.69\) . Suppose the median P/E of 14.40 for the peer group is subjectively adjusted upward to 15.00 to reflect T’s superior profitability and below-average risk. Estimate T’s intrinsic value.

iii. T ’s current market price is \($33.99\) . State whether T appears to be fairly valued, overvalued, or undervalued when compared with the intrinsic value estimated in answer to Part 2 above.

Step by Step Answer: