Edward Stavos is a junior analyst at a major US pension fund. Stavos is researching Barclays PLC

Question:

Edward Stavos is a junior analyst at a major US pension fund. Stavos is researching Barclays PLC (LSE: BARC and NYSE: BCS) for his fund’s Credit Services Portfolio and is preparing background information prior to an upcoming meeting with the company.

Headquartered in London, United Kingdom, Barclays is a major global financial services provider engaged in personal banking, credit cards, corporate and investment banking, and wealth and investment management with an extensive international presence in Europe, the Americas, Africa, and Asia.

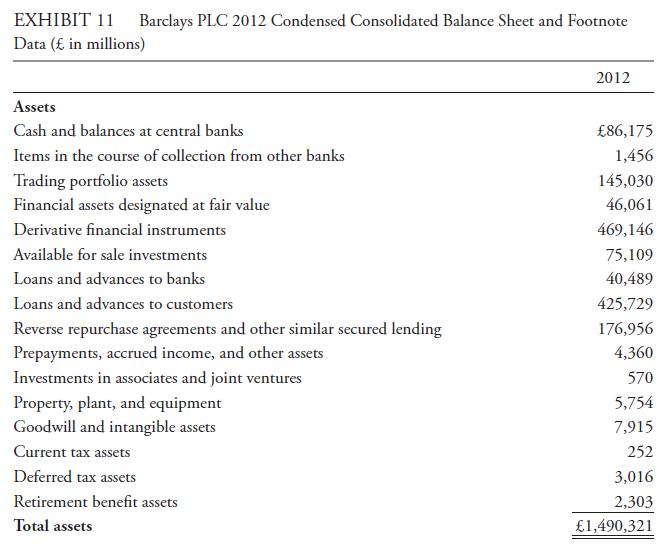

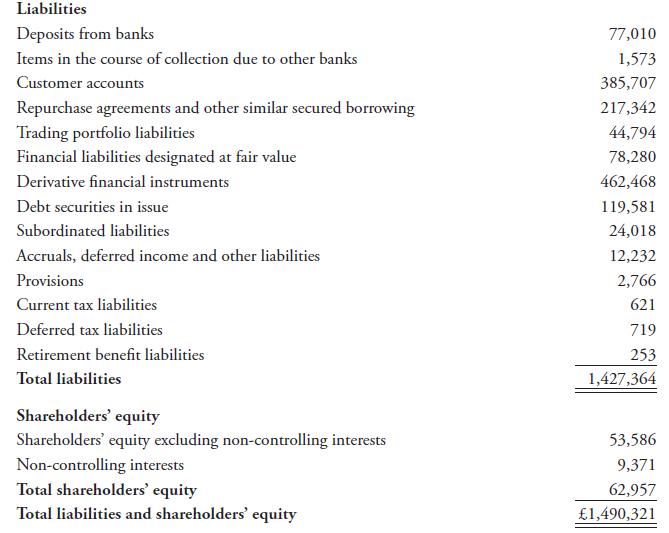

Stavos is particularly interested in Barclays’ P/B and how adjusting asset and liability accounts to their current fair value impacts the ratio. He gathers the condensed 2012 balance sheet (as of 31 December) and footnote data from Barclay’s website as shown in Exhibit 11.

The 31 December 2012 share price for Barclays was £2.4239, and the diluted weighted average number of shares was 12,614 million. Stavos computes book value per share initially by dividing total shareholders’ equity by the by the share count and arrives at a book value per share of £4.9910 (£62,957/12,614) and a P/B of 0.49 (£2.4239/£4.9910).

Stavos then computes tangible book value per share as £4.3636 (calculated as £62,957 minus £7,915 of goodwill and intangible assets, which is then divided by 12,614 shares). The P/B ratio based on tangible book value per share is 0.56 (£2.4239/£4.3636).

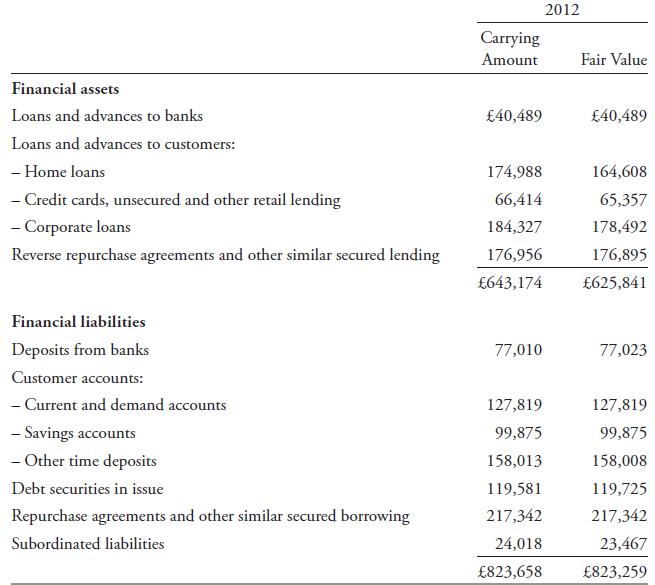

Stavos then turns to the footnotes to examine the fair value data. He notes the fair value of financial assets is £17,333 million less than their carrying amount (£643,174 – £625,841) and the fair value of financial liabilities is £399 million less than their carrying amount (£823,658 – £823,259). Including these adjustments to tangible book value results in an adjusted book value per share of £3.0211 [(£62,957 – £7,915 ‒ £17,333 + £399)/12,614]. Stavos’ adjusted P/B ratio is 0.80 (£2.4239/£3.0211).

Stavos is concerned about the wide range in his computed P/B ratios. He knows that if quoted prices are not available for financial assets and liabilities, IAS 39 allows for the use of valuation models to estimate fair value. He decides to question management regarding their use of models to value assets, liabilities, and derivatives and the sensitivity of these accounts to changes in interest rates and currency values.

Step by Step Answer: