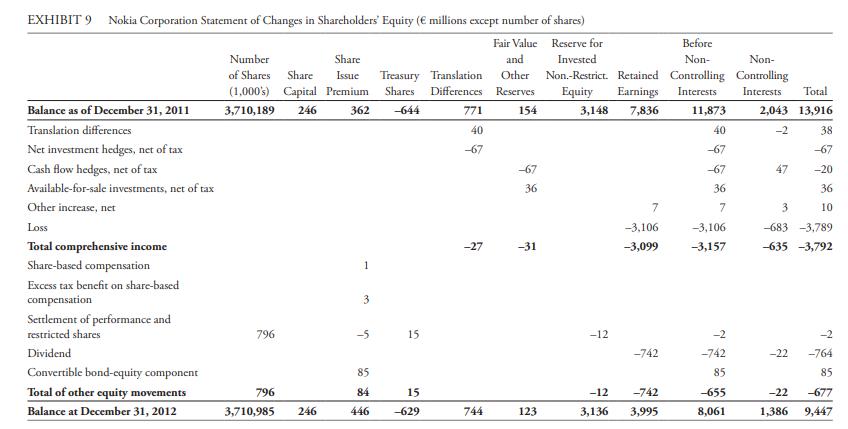

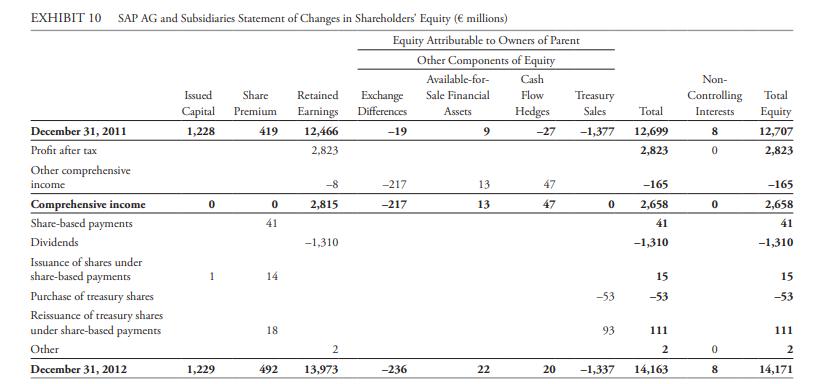

Excerpts from two companies statements of changes in stockholders equity are shown in Exhibits 9 and 10.

Question:

Excerpts from two companies’ statements of changes in stockholders’ equity are shown in Exhibits 9 and 10. The first statement, prepared under IFRS as of 31 December 2012, is for Nokia Corporation (NYSE: NOK), a leading manufacturer of mobile phones headquartered in Finland and with operations in four business segments: mobile phones, multimedia, enterprise solutions, and networks. The second statement, prepared under US GAAP as of 31 December 2012, is for SAP AG (NYSE: SAP), which is headquartered in Germany and is a worldwide provider of enterprise application software, including enterprise resource planning, customer relationship management, and supply chain management software.

For Nokia, items that have bypassed the income statement in 2012 are those in the columns labeled “Share issue premium,” “Translation differences,” “Fair value and other reserves,” and “Reserve for invested non-restricted equity.” For SAP, the amounts that bypassed the income statement in 2012 are “Share premium,” “Exchange differences,”

“Available-for-sale financial assets,” and “Cash flow hedges.”

To illustrate the issues in interpreting these items, consider the columns “Translation differences” (Nokia) and “Exchange differences” (SAP). The amounts in these columns reflect currency translation adjustments to equity that have bypassed the income statement. For Nokia, the adjustment for the year 2012 was –€27 million. Because this is a negative adjustment to stockholders’ equity, this item would have decreased income if it had been reported on the income statement. The balance is not increasing, however;

it appears to be reversing to zero over time. For SAP, the translation adjustment for the year 2012 was –€217 million. Again, because this is a negative adjustment to stockholders’ equity, this item would have decreased income if it had been reported on the income statement. In this case, the negative balance appears to be accumulating: It does not appear to be reversing (netting to zero) over time. If the analyst expects this trend to continue and has used historical data as the basis for initial estimates of ROE to be used in residual income valuation, a downward adjustment in that estimated future ROE might be warranted. It is possible, however, that future exchange rate movements will reverse this accumulation.

Step by Step Answer: