For the next five years, the annual dividends of a stock are expected to be ($2.00), ($2.10),

Question:

For the next five years, the annual dividends of a stock are expected to be \($2.00\), \($2.10\), \($2.20\), \($3.50\), and \($3.75\). In addition, the stock price is expected to be \($40.00\) in five years. If the required return on equity is 10 percent, what is the value of this stock?

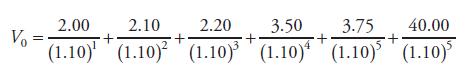

The present values of the expected future cash flows can be written out as

Calculating and summing these present values gives a stock value of V0 = 1.818 + 1.736 + 1.653 + 2.391 + 2.328 + 24.837 = \($34.76\).

The five dividends have a total present value of \($9.926\), and the terminal stock value has a present value of \($24.837\), for a total stock value of \($34.76\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: