In Example 17, the analyst estimated the dividend growth rate of IBM in the final stage of

Question:

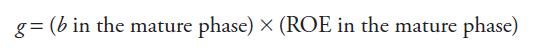

In Example 17, the analyst estimated the dividend growth rate of IBM in the final stage of a three-stage model as 6.75 percent. This value was based on the expression

IBM’s payout ratio has increased from 16.5 percent to 22.7 percent over the last 10 years. Assuming that in the final stage IBM has a payout ratio of 25 percent and achieves a ROE equal to its estimated required return on equity of 9 percent, the calculation is:

Data From Example 17:-

IBM (as of early 2013) pays a dividend of \($3.30\) per year. A current price is \($194.98\). An analyst makes the following estimates:

• the current required return on equity for IBM is 9 percent, and

• dividends will grow at 14 percent for the next two years, 12 percent for the following five years, and 6.75 percent thereafter.

Based only on the information given, estimate the value of IBM using a three-stage DDM approach.

Step by Step Answer: