Steve Bono is valuing the equity of Petroleo Brasileiro (NYSE: PBR), commonly known as Petrobras, in early

Question:

Steve Bono is valuing the equity of Petroleo Brasileiro (NYSE: PBR), commonly known as Petrobras, in early 2013 (before the release of 2012 financial results) by using the single-stage (constant-growth) FCFE model. Estimated FCFE for 2012 is 1.05 Brazilian reais (BRL). Bono’s best estimates of input values for the analysis are as follows:

• The FCFE growth rate is 6.0 percent.

• The risk-free rate is 5.2 percent.

• The equity risk premium is 5.5 percent.

• Beta is 1.2.

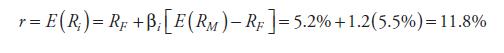

Using the capital asset pricing model (CAPM), Bono estimates that the required rate of return for Petrobras is

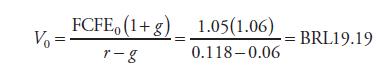

The estimated value per share is

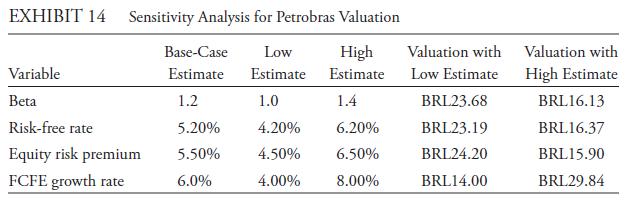

Exhibit 14 shows Bono’s base case and the highest and lowest reasonable alternative estimates. The column “Valuation with Low Estimate” gives the estimated value of Petrobras based on the low estimate for the variable on the same row of the first column and the base-case estimates for the remaining three variables. “Valuation with High Estimate” performs a similar exercise based on the high estimate for the variable at issue.

As Exhibit 14 shows, the value of Petrobras is very sensitive to the inputs. Of the four variables presented, the stock valuation is least sensitive to the range of estimates for the risk-free rate and beta. The range of estimates for these variables produces the smallest ranges of stock values (from BRL16.37 to BRL23.19 for the risk-free rate and from BRL16.13 to BRL23.68 for beta). The stock value is most sensitive to the extreme values for the FCFE growth rate and, to a lesser degree, the equity risk premium. Of course, the variables to which a stock price is most sensitive vary from case to case. A sensitivity analysis gives the analyst a guide as to which variables are most critical to the final valuation.

Step by Step Answer: