Walgreens and Rite Aid are two of the largest retail drugstore chains in the United States. For

Question:

Walgreens and Rite Aid are two of the largest retail drugstore chains in the United States. For both companies, around two-thirds of their sales are from prescription pharmaceuticals, with the remaining third coming from front-of-store categories, such as beauty products, over-the-counter drugs, convenience foods, greeting cards, and photofinishing.

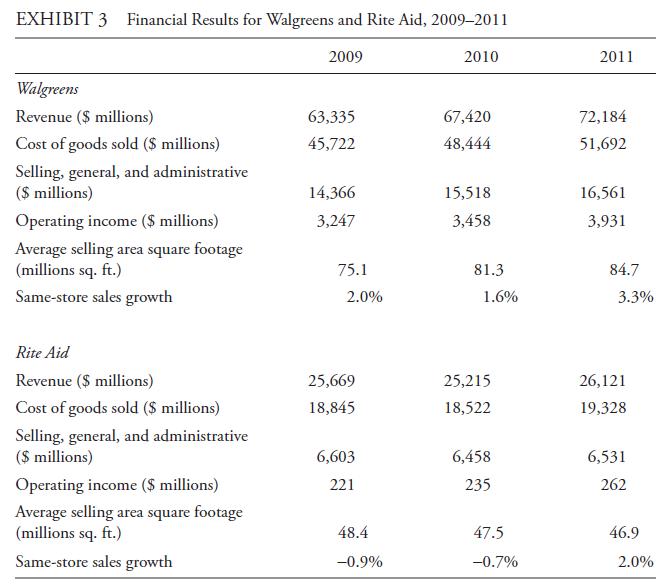

Although they are in the same industry, Walgreens and Rite Aid have very different operating margins. There is reason to believe that economies of scale exist in the drugstore business. For example, larger drugstore companies have greater bargaining leverage with suppliers and the ability to negotiate better reimbursement rates with third-party payers. Some relevant data are presented in Exhibit 3. The 2011 column includes results from Walgreens’ 2011 fiscal year (ended in August 2011) and Rite Aid’s fiscal year 2012

(ended in February 2012).

Customer service may be one driver of revenue for the retail drug business. Retail analysts commonly use a combination of qualitative and quantitative evidence to assess customer service. Qualitative evidence might come from personal store visits or customer surveys. Quantitative evidence may be based on metrics such as selling, general, and administrative (SG&A) expense per square foot. Too little spending on SG&A might indicate that stores are understaffed. Relatedly, same-store sales growth may be an indicator of customer satisfaction.

Use the data given to answer the following questions:

i. On the basis of the 2011 operating margins for Walgreens and Rite Aid, is there evidence suggesting that economies of scale exist in the retail drugstore business? If so, are economies of scale realized in cost of goods sold or SG&A expenses?

ii. Marco Benitez is a US-based equity analyst with an independent research firm.

Benitez is researching service levels in the US drugstore industry.

A. Calculate and interpret Walgreens’ and Rite Aid’s SG&A per average square foot over the past three years.

B. Assuming that customer satisfaction is a driver of sales growth, which company appears to have a more satisfied customer base over the period examined?

C. Benitez projects that Rite Aid’s average selling area square footage will decline 2% annually over the next three years. He believes SG&A per average square foot will increase 1% annually during this time. What is Benitez’s projection for total SG&A expense in 2014?

iii. Jason Lewis is another US-based equity analyst covering the retail drugstore industry.

He is considering several approaches to forecasting Walgreens’ and Rite Aid’s’

future costs. Classify each of the following as a bottom-up, top-down, or hybrid approach.

A. L ewis believes government insurance programs in the United States will face budgetary pressures in the future, which will result in lower reimbursements across the retail drugstore industry. Lewis thinks this will lower all drugstores’

gross margins.

B. L ewis projects that Walgreens’ historical rate of growth in SG&A expenses will continue for the next five years. But in the long-run, he projects SG&A to grow at the rate of inflation.

C. T o estimate Rite Aid’s future lease expense, Lewis makes assumptions about square footage growth and average rent per square foot, based on past experience.

Step by Step Answer: