William Leiderman is a portfolio manager for a US pension funds domestic equity portfolio. The portfolio is

Question:

William Leiderman is a portfolio manager for a US pension fund’s domestic equity portfolio. The portfolio is exempt from taxes, so any differences in the taxation of dividends and capital gains are not relevant. Leiderman’s client requires high current income.

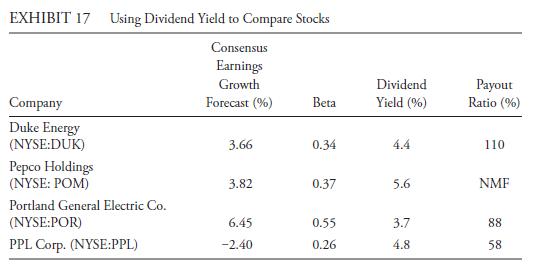

Leiderman is considering the purchase of utility stocks for the fund in November 2013. In the course of his review he considers the four large-cap US electric utilities shown in Exhibit 17.

All of the securities exhibit similar low market risk; they each have a beta less than 1.00. Although POM has the highest dividend yield, its dividend payout ratio is not meaningful due to a negative EPS. DUK’s dividend payout ratio of 110 percent, the highest of the group, also suggests that its dividend may be subject to greater risk.

Leiderman notes that PPL’s relatively low payout ratio means that the dividend is well supported; however, the expected negative earnings growth rate is a negative factor.

Summing POR’s dividend yield and expected earnings growth rate, Leiderman estimates POR’s expected total return as about 10.2 percent; because the total return estimate is relatively attractive and because POR does not appear to have any strong negatives, Leiderman decides to focus his further analysis on POR.

Step by Step Answer: