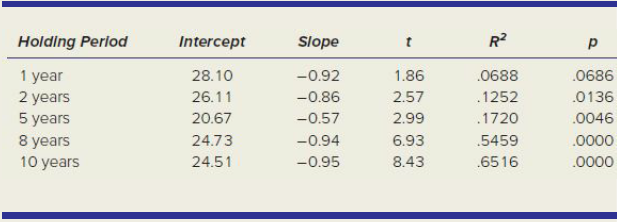

Below are results of a regression of Y = average stock returns (in percent) as a function

Question:

Below are results of a regression of Y = average stock returns (in percent) as a function of X = average price/earnings ratios for the period 1949?1997 (49 years). Separate regressions were done for various holding periods (sample sizes are therefore variable).

(a) Summarize what the regression results tell you.

(b) Would you anticipate auto-correlation in this type of data? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essential Statistics In Business And Economics

ISBN: 9781260239508

3rd Edition

Authors: David Doane, Lori Seward

Question Posted: