In Problem 5 , what is the average tax rate? What is the marginal tax rate? Duela

Question:

In Problem 5, what is the average tax rate? What is the marginal tax rate?

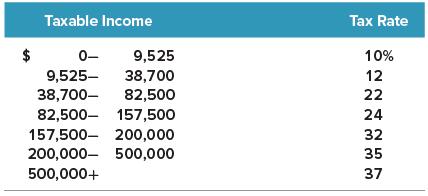

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.

Transcribed Image Text:

Taxable Income Tax Rate 0- 9,525 10% 9,525- 38,700- 38,700 82,500 12 22 82,500- 157,500 24 157,500- 200,000 200,000- 500,000 32 35 500,000+ 37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

The average tax rate is the total taxes paid divided by taxable income so Avera...View the full answer

Answered By

Ehsan Mahmood

I’ve earned Masters Degree in Business Studies and specialized in Accounts & Finance. Couple with this, I have earned BS Sociology from renowned institute of Pakistan. Moreover, I have humongous teaching experience at Graduate and Post-graduate level to Business and humanities students along with more than 7 years of teaching experience to my foreign students Online. I’m also professional writer and write for numerous academic journals pertaining to educational institutes periodically.

4.90+

248+ Reviews

287+ Question Solved

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

The SGS Co. had $215,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company's income taxes. In Problem 6, what is the average tax rate? What is the marginal tax...

-

Refer to the corporate marginal tax rate information in Table 2.3. a. Why do you think the marginal tax rate jumps up from 34 percent to 39 percent at a taxable income of $100,001, and then falls...

-

Using Excel to find the marginal tax rate can be accomplished using the VLOOKUP function. However, calculating the total tax bill is a little more difficult. Below we have shown a copy of the IRS tax...

-

Selected data from a February payroll register for Halverson Company are presented below. Some amounts are intentionally omitted. FICA taxes are 7.65%. State income taxes are 4% of gross earnings....

-

Explain what happens to the sequence of DNA during trinucleotide repeat expansion (TNRE). If someone was mildly affected with a TNRE disorder, what issues would be important when considering possible...

-

The chilling room of a meat plant is 15 m 18 m 5.5 m in size and has a capacity of 350 beef carcasses. The power consumed by the fans and the lights in the chilling room are 22 and 2 kW,...

-

Reconsider Parts (a) through (f) of Problem 2. For each "true" statement, develop a mathematical proof based on the time value of money factor equations from Table 2.6 in Chapter 2. Data from problem...

-

On May 1, 2017, Herron Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2017 and pay interest annually on May 1. Financial statements are prepared annually on...

-

Hobbits are a simple hole-dwelling folk who live in the Shire in northwestern Middle-Earth. They are known for their fondness for food and the comforts of home. Answer each of the following: a. There...

-

A company produces several products which pass through the two production departments in its factory. These two departments are concerned with filling and sealing operations. There are two service...

-

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.? Taxable Income Tax Rate 9,525 10% 9,525 38,700 12 38,700- 82,500...

-

Benson, Inc., has sales of $38,530, costs of $12,750, depreciation expense of $2,550, and interest expense of $1,850. If the tax rate is 21 percent, what is the operating cash flow, or OCF?

-

Pace Company purchased 20,000 of the 25,000 shares of Saddler Corporation for $525,000. On January 3, 2019, the acquisition date, Saddler Corporation?s capital stock and retained earnings account...

-

Give an example of an option to abandon a project. Why might this be of value?

-

As interest rates increase, why does the price of a long-term bond decrease more than that of a short-term bond?

-

What is the determinant of a firms operating risk?

-

The dividend policy of Scorpio Inc. has been recently changed to payout 40 percent of its earnings to shareholders. The company has just paid dividends of $3 per share. a. Calculate the growth rate...

-

Explain how simulations work.

-

One of the great new "marketplaces" of our time is eBay. Spend some time on the eBay Web site (www.ebay.com). Find a product that you are interested in and follow the bidding. How much would you be...

-

Saccharin is an artificial sweetener that is used in diet beverages. In order for it to be metabolized by the body, it must pass into cells. Below are shown the two forms of saccharin. Saccharin has...

-

Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits.

-

Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits.

-

Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits.

-

Jenny wishes to accumulate $10000 over 5 years for an overseas trip. She will make a deposit every 6-months, and the funds will earn the interest rate of 4% per annum compounded semi-annually. How...

-

Write a short C++ program that will prompt the user and input three integer values (month, day, year) from the console in a "date" format that includes '/' separator characters. e.g., 8/21/2013. Your...

-

Aimee is the owner of a stock with annual returns of 12.3 percent, -5.0 percent, 6.6 percent, and 18.2 percent for the past four years. She thinks the stock may achieve a return of 27 percent this...

Study smarter with the SolutionInn App