Refer to the observed capital structures given in Table 17.3 of the text. What do you notice

Question:

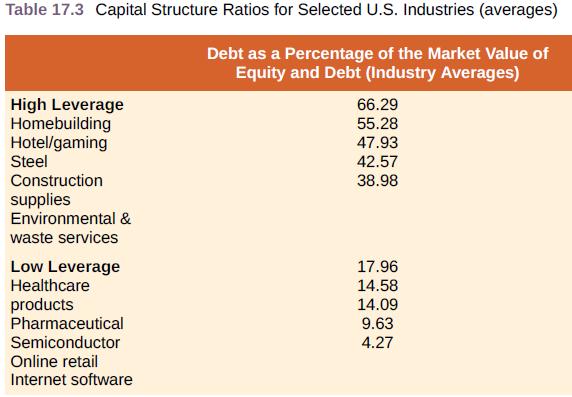

Refer to the observed capital structures given in Table 17.3 of the text. What do you notice about the types of industries with respect to their average debt-equity ratios? Are certain types of industries more likely to be highly leveraged than others? What are some possible reasons for this observed segmentation? Do the operating results and tax history of the firms play a role? How about their future earnings prospects? Explain.

Transcribed Image Text:

Table 17.3 Capital Structure Ratios for Selected U.S. Industries (averages) Debt as a Percentage of the Market Value of Equity and Debt (Industry Averages) High Leverage Homebuilding Hotel/gaming Steel 66.29 55.28 47.93 42.57 38.98 Construction supplies Environmental & waste services 17.96 Low Leverage Healthcare 14.58 products Pharmaceutical 14.09 9.63 Semiconductor 4.27 Online retail Internet software

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

The more capital intensive industries such as air transport tel...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Refer to the observed capital structures given in Table 13.5 of the text. What do you notice about the types of industries with respect to their average debt-equity ratios? Are certain types of...

-

What do you notice in each well immediately after adding the potassium permanganate solution?

-

What do you notice when the bromine solution is stirred with each compound?

-

1. Construct a simple pendulum starting with 20 cm length. 2. Hang the pendulum as pictures in one of the two methods shown above. 3. Using the protractor, displace the pendulum 10 degrees from the...

-

Calculate the standard enthalpy change for the reaction 2Al(s) + Fe2O3(s) - 2Fe(s) + Al2O3(s) given that 2Al(s) +3O2(g)- Al2O3(s) n_-1669 - F603(s) .8 mol 2Fe(s) + O2(g) -MR00-822.2 kJ/mol 2(g)

-

In the investment world, commodities are typically pretty boring. From livestock to grains to steel and other metals, commodities have their ups and downs. But long term, the world will always need...

-

When conducting an incremental analysis, what step must always be taken immediately prior to beginning the pairwise comparisons? a. Order the alternatives from highest to lowest initial investment b....

-

Lansbury Company purchases equipment on January 1, Year 1, at a cost of $518,000. The asset is expected to have a service life of 12 years and a salvage value of $50,000. (a) Compute the amount of...

-

(20%) A Fabry-Perot resonant cavity consists of a thin glass plate that has a refractive index of n = 1.50 and a thickness of = 100 m. Its surfaces are coated such that its peak transmittance is 100%...

-

A study was done on a diesel-powered light-duty pickup truck to see if humidity, air temperature, and barometric pressure influence emission of nitrous oxide (in ppm). Emission measurements were...

-

Fountain Corporations economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two...

-

Edwards Construction currently has debt outstanding with a market value of $95,000 and a cost of 9 percent. The company has EBIT of $8,550 that is expected to continue in perpetuity. Assume there are...

-

Quality of earnings analysis is a very important tool in assessing the value of a company and its shares. The chapter presents a framework for evaluating quality of earnings. Instructions Do an...

-

Required information [The following information applies to the questions displayed below.] Assume you are the president of High Power Corporation. At the end of the first year of operations (December...

-

The collection of a $1900 account receivable within the 2 percent discount period will result in an increase to Accounts Receivable for $1862. a decrease to Cash for $1862. O a decrease to Accounts...

-

View Policies Current Attempt in Progress Sheridan Ltd. has the following selected transactions: 1. 2. 3. 4. 5. 6. 7. 8. Issued common shares to shareholders in exchange for $6,800. Paid rent in...

-

5 Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs: Direct materials Direct labor Variable...

-

Current Attempt in Progress A list of financial statement items for Crane Company includes the following: accounts receivable $15,400, prepaid insurance $2,860, cash $11,440, supplies $4,180, and...

-

Suppose you need a bank loan to purchase lawn equipment for Ralph's Landscaping Service. In evaluating your loan request, the banker asks about the assets and liabilities of your business. In...

-

Will the prediction interval always be wider than the estimation interval for the same value of the independent variable? Briefly explain.

-

Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6%. You hold the bond for five years before selling it. a. If the bonds yield to maturity is 6% when you sell it, what is...

-

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: Security Yield (%) Treasury 3.1 AAA corporate 3.2 BBB corporate 4.2 B corporate 4.9 a. What is the...

-

Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7% (annual coupon payments) and a face value of $1000. Andrew believes it can get a rating of A from Standard & Poors....

-

The answer of the fiurth line is not 4, 8, 32 or 40. I just need the answer for the fourth line Question 1 Memory Allocation SUBMITTED How much memory (in bytes) is taken up by the following...

-

Critical Thinking 10-7: Dynamic Mobile Access There are so many opportunities now for people to allow constant and dynamic connection between their mobile phone and an external (often unregulated)...

-

In Matlab, create a code that puts the value three-halves pi radians, 3 ????, in a variable named "angle". Then set another variable named angleDegrees equal to a calculation that converts the value...

Study smarter with the SolutionInn App