Sam McKenzie is the founder and CEO of McKenzie Restaurants, Inc., a regional company. Sam is considering

Question:

Sam McKenzie is the founder and CEO of McKenzie Restaurants, Inc., a regional company. Sam is considering opening several new restaurants. Sally Thornton, the company’s CFO, has been put in charge of the capital budgeting analysis. She has examined the potential for the company’s expansion and determined that the success of the new restaurants will depend critically on the state of the economy over the next few years.

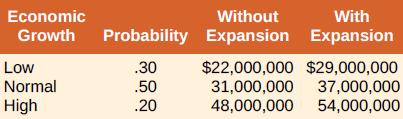

McKenzie currently has a bond issue outstanding with a face value of $26 million that is due in one year. Covenants associated with this bond issue prohibit the issuance of any additional debt. This restriction means that the expansion will be entirely financed with equity at a cost of $5.4 million. Sally has summarized her analysis in the following table, which shows the value of the company in each state of the economy next year, both with and without expansion:

1. What is the expected value of the company in one year, with and without expansion? Would the company’s stockholders be better off with or without expansion? Why?

2. What is the expected value of the company’s debt in one year, with and without the expansion?

3. One year from now, how much value creation is expected from the expansion? How much value is expected for stockholders? Bondholders?

4. If the company announces that it is not expanding, what do you think will happen to the price of its bonds? What will happen to the price of the bonds if the company does expand?

5. If the company opts not to expand, what are the implications for the company’s future borrowing needs? What are the implications if the company does expand?

6. Because of the bond covenant, the expansion would have to be financed with equity. How would it affect your answer if the expansion were financed with cash on hand instead of new equity?

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan