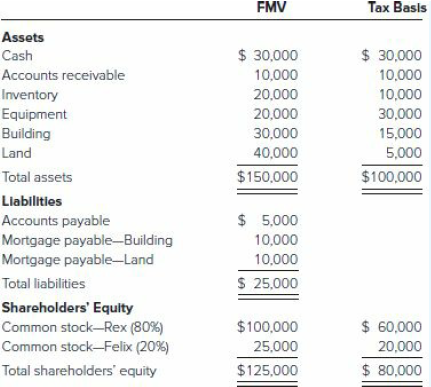

Rex and Felix are the sole shareholders of the Dogs and Cats Corporation (DCC). After several years

Question:

a. Compute the gain or loss recognized by DCC, Rex, and Felix on a complete liquidation of the corporation, assuming each shareholder receives a pro rata distribution of the corporation€™s assets and assumes a pro rata amount of the liabilities.

b. Compute the gain or loss recognized by DCC, Rex, and Felix on a complete liquidation of the corporation, assuming Felix receives $25,000 in cash and Rex receives the remainder of the assets and assumes all of the liabilities. Assume Felix received the accounts receivable and equipment and assumed the accounts payable.

c. Will Felix recognize any income when he collects the accounts receivable?

d. Will Felix be able to take a deduction when he pays the accounts payable? Assume Rex is a corporate shareholder of DCC.

e. Compute the gain or loss recognized by DCC, Rex, and Felix on a complete liquidation of the corporation, assuming each shareholder receives a pro rata

distribution of the corporation€™s assets and assumes a pro rata amount of the liabilities.

f. Compute the gain or loss recognized by DCC, Rex, and Felix on a complete liquidation of the corporation,assuming Felix receives all cash and Rex receives the remainder of the assets and assumes all of the liabilities. Assume the equipment was contributed by Rex to DCC in a §351 transaction two months prior to the liquidation. At the time of the contribution, the property€™s fair market value was $25,000.

g. Would the tax result change if the property was contributed one year ago? Two years ago? Three years ago?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver