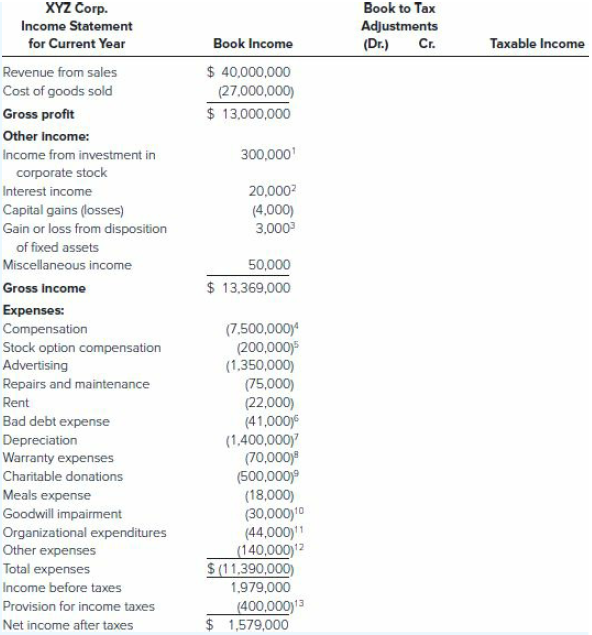

XYZ is a calendar-year corporation that began business on January 1, 2018. For the year, it reported

Question:

Required:

Identify the book-to-tax adjustments for XYZ.

a. Reconcile book income to taxable income and identify each book€“tax difference as temporary or permanent.

b. Compute XYZ€™s income tax liability.

c. Complete XYZ€™s Schedule M-1.

d. Complete XYZ€™s Form 1120, page 1 (use the most current form available). Ignore estimated tax penalties when completing this form.

e. Determine the quarters for which XYZ is subject to underpayment of estimated taxes penalties (see assumptions and estimated tax information below).

Notes:

1. XYZ owns 30 percent of the outstanding Hobble Corp. (HC) stock. Hobble Corp. reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method and it recorded its pro rata share of HC€™s earnings for the year ($1,000,000 × 30%). HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the actual dividend received as income, not the pro rata share of HC€™s earnings.

2. Of the $20,000 interest income, $5,000 was from a City of Seattle bond, $7,000 was from a Tacoma City bond, $6,000 was from a fully taxable corporate bond, and the remaining $2,000 was from a money market account.

3. This gain is from equipment that XYZ purchased in February and sold in December (that is, it does not qualify as §1231 gain).

4. This includes total officer compensation of $2,500,000 (no one officer received more than $1,000,000 compensation).

5. This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers).

6. XYZ actually wrote off $27,000 of its accounts receivable as uncollectible.

7. Tax depreciation was $1,900,000.

8. In the current year, XYZ did not make any actual payments on warranties it provided to customers.

9. XYZ made $500,000 of cash contributions to qualified charities during the year.

10. On July 1 of this year XYZ acquired the assets of another business. In the process it acquired $300,000 of goodwill. At the end of the year, XYZ wrote off $30,000 of the goodwill as impaired.

11. XYZ expensed all of its organizational expenditures for book purposes. It expensed the maximum amount of organizational expenditures allowed for tax purposes.

12. The other expenses do not contain any items with book€“ tax differences.

13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes.

Estimated Tax Information: XYZ made four equal estimated tax payments totaling $360,000. For purposes of estimated tax liabilities, assume XYZ was in existence in 2017 and that in 2017 it reported a tax liability of $500,000. During 2018, XYZ determined its taxable income at the end of each of the four quarters as follows:

Quarter-End...........Cumulative taxable income (loss)

First.........................$400,000

Second....................$1,100,000

Third........................$1,400,000

Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver