Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in

Question:

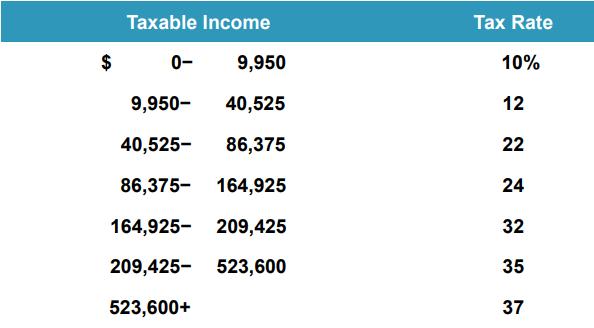

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes. What is the average tax rate? What is the marginal tax rate?

Data in Table 2.3

Personal tax rates for 2021 (unmarried individuals)

Transcribed Image Text:

$ Taxable Income 0- 9,950 9,950- 40,525 40,525- 86,375 86,375- 164,925 164,925- 209,425 209,425 523,600 523,600+ Tax Rate 10% 12 22 24 32 35 37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Taxes 109950 1240425 9950 2286375 40425 24164925 86375 32189000 164925 Taxes 41307 The av...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9781265414962

11th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.? Taxable Income Tax Rate 9,525 10% 9,525 38,700 12 38,700- 82,500...

-

Duela Dent is single and had $192,000 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round...

-

What is the average tax rate for a person who paid taxes of $4,864.14 on total taxable income of $39,870?

-

In Problems 5978, solve each equation in the complex number system. x 2 - 4 = 0

-

When a benchmark approach is used to set materiality at the financial statement level, why are different benchmarks used for different types of entities, or companies in different entities?

-

Find the equivalent transfer function, T(s) = C(s)/R(s), for the system shown in Figure P5.3. G1 R(s) + G5 G6 C(s) G2 G3 G4 G7 FIGURE P5.3

-

Explain plane milling, end milling, slot milling, with a neat sketch.

-

Calculating Annuity Cash Flows If you put up $28,000 today in exchange for a 8.25 percent, 15- year annuity, what will the annual cash flow be?

-

Two resultant forces 100kN and Q kN acting at a point at an angle 90 between them. If resultant force is 200kN, find value of Q. Also find angle made by resultant with 100kN force?

-

1. How do the pros and cons of the Qwikster structure fit with those associated with the divisional structure (see Section 14.2.2)? 2. In the light of the planning, cultural, market and targeting...

-

a. What is the balance sheet identity? b. What is liquidity? Why is it important? c. What do we mean by financial leverage? d. Explain the difference between accounting value and market value. Which...

-

A beam with a T-section is supported and loaded as shown in the figure. The cross-section has width b = 21/2 in, height h = 3 in., and thickness t = 3/8 in. (a) Determine the maximum tensile and...

-

If Qais and Lyla combine their savings of US$1,260 and US$975, respectively, and deposit this amount into an account that pays 2 percent annual interest, com- pounded monthly, what will the account...

-

One of the most important concepts about court justice can sometimes be the very right to get into the courthouse door. In Chapter 2, we have learned, and will be learning about "jurisdiction",...

-

Compose program to information and print whether a number is positive or negative. complete java program that prompts the client for their name and two numbers. Compose program that will request that...

-

NSIGHT The four work centers process several jobs during the week. This particular chart indicates that the metalworks and painting centers are completely loaded for the entire week. The mechanical...

-

A retiree is paid $1800 per month by an annuity. If the income is invested in an account that earns 4% interest compounded continuously, what is the future value of the income after ten years? (Round...

-

Summarize the facts of the case briefly - two or three sentences is ok, but include in your discussion the facts that become important to the Court's decision. Then, summarize the primary holding of...

-

A projectile is fired straight upward at 141 m/s. How fast is it moving at the instant it reaches the top of its trajectory? Suppose that it were fired upward at 45 instead. Then its horizontal...

-

For the following exercises, find the inverse of the function and graph both the function and its inverse. f(x) = 4 x 2 , x 0

-

Current Ratio What effect would the following actions have on a firms current ratio assume that net working capital is positive. a. Inventory is purchased. b. A supplier is paid. c. A short-term bank...

-

Current Ratio Explain what it means for a firm to have a current ratio equal to .50. Would the firm be better off if the current ratio were 1.50? What if it were 15.0? Explain your answers.

-

Current Ratio Explain what it means for a firm to have a current ratio equal to .50. Would the firm be better off if the current ratio were 1.50? What if it were 15.0? Explain your answers.

-

Exeter Group Is a large retail company that has brick-and-mortar outlets throughout the Southeast. They have been in business for many years, but two years ago started an online sales channel to...

-

Consider a max-heap H of size n > 2 of distinct elements. a. (7 points) What is the maximum number of element comparisons that are needed to find the second largest element in H? Clearly justify your...

-

1. Analyze the time complexity of the following variant of merge sort: divide the array into three parts, sort each part recursively, and merge the results. 2. Design an algorithm to search for log n...

Study smarter with the SolutionInn App