A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the

Question:

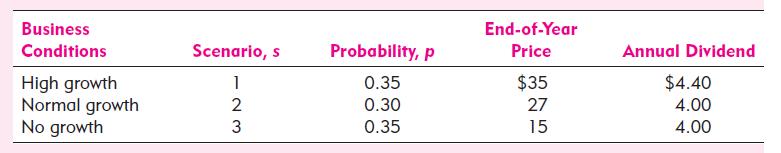

A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about next year’s holding-period return on the stock by specifying three possible scenarios:

What are the annual holding-period returns of A-Star stock for each of the three scenarios? Calculate the expected HPR and the standard deviation of the HPR.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted: