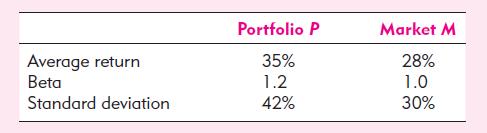

Consider the following data for a particular sample period: Calculate the following performance measures for portfolio P

Question:

Consider the following data for a particular sample period:

Calculate the following performance measures for portfolio P and the market: Sharpe, Jensen (alpha), and Treynor. The T-bill rate during the period was 6%. By which measures did portfolio P outperform the market?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted: