Show that the initial value of the call option in Example 16.1 is $4.434. a. Confirm that

Question:

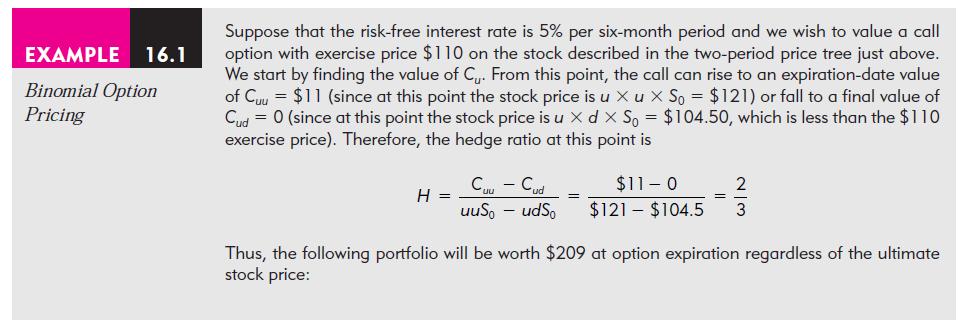

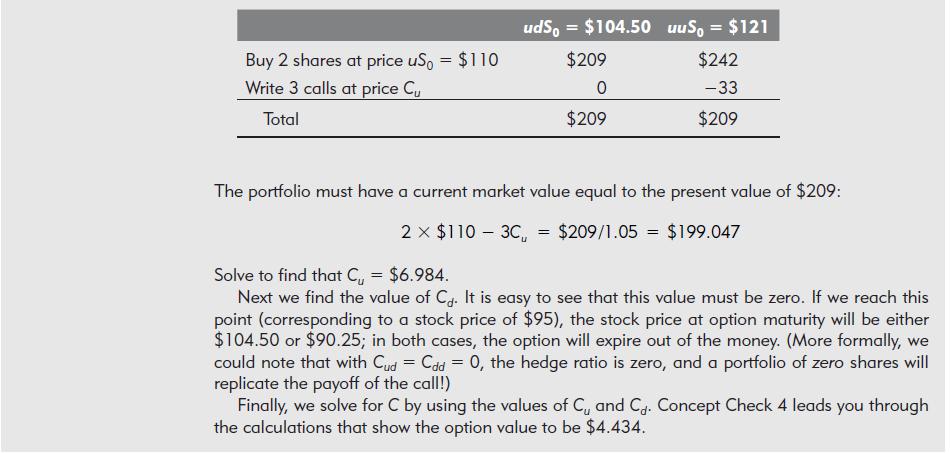

Show that the initial value of the call option in Example 16.1 is $4.434.

a. Confirm that the spread in option values is Cu = Cd = $6.984.

b. Confirm that the spread in stock values is uS0 = dS0 = $15.

c. Confirm that the hedge ratio is .4656 shares purchased for each call written.

d. Demonstrate that the value in one period of a portfolio comprising .4656 shares and one call written is riskless.

e. Calculate the present value of this payoff.

f. Solve for the option value.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted: