Assume in problem 46 above that Matt had received property 2 , subject to a ($ 70,000)

Question:

Assume in problem 46 above that Matt had received property 2 , subject to a \(\$ 70,000\) mortgage, rather than property 3 . Matt assumed responsibility for the mortgage in connection with the distribution. As before, the distribution reduced Matt's interest in the partnership from one-third to one-seventh.

a. Will Matt recognize any gain or loss in connection with this distribution?

b. What basis will Matt take in property 2?

c. What will be Matt's remaining tax basis in his partnership interest?

problem 46

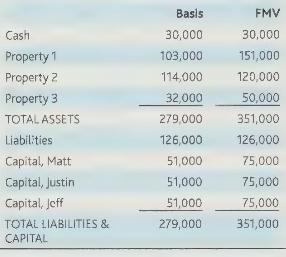

Williams Brotherŝ Partnership had the following balance sheets at December 31:

All three properties owned by the partnership are investment properties. On December 31 , the partnership distributed property 3 to Matt, reducing his interest in the partnership from one-third to one-seventh.

a. Will Matt recognize any gain or loss in connection with this distribution?

b. What will be Matt's tax basis in property 3 received from the partnership?

c. What will be Matt's remaining tax basis in his partnership interest?

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback