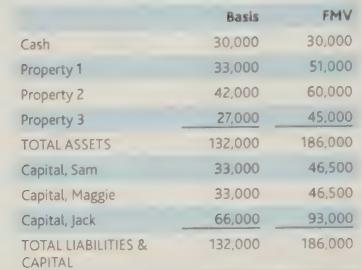

Bust-out Partners had the following balance sheets at year-end: On December 31, Jack sold his fifty percent

Question:

Bust-out Partners had the following balance sheets at year-end:

On December 31, Jack sold his fifty percent interest in the partnership to an unrelated buyer for $93,000. None of the partnership's properties constitute inventory or unrealized receivables.

a. How much gain must Jack recognize on the sale?

b. What will be the buyer's tax basis in the newly acquired partnership interest?

c. Assume the partnership has a Section 754 election in effect. Determine the amount of the partnership's basis adjustment under Section 743(b), and allocate the adjustment among the partnership's assets.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: