Comprehensive Problem (Tax Return} Problem). Mr. and Mrs. Sam Morris retired on February 10,2018, and call you

Question:

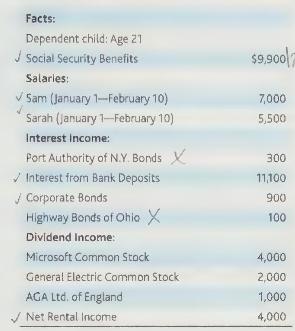

Comprehensive Problem (Tax Return} Problem). Mr. and Mrs. Sam Morris retired on February 10,2018, and call you in for tax advice. Both Sam and his wife Sarah have worked for many years. Sam is 65 years of age and his wife is 63 .

One of their tenants moved out on July 14, 2018, and Sam determines that they had damaged the stove, and therefore returned only \(\$ 50\) of their \(\$ 150\) security deposit.

The Morrises' daughter borrowed \(\$ 10,000\) two years ago to purchase a new automobile. She has made payments to her parents and on September 1, 2018, only \(\$ 2,500\) was still outstanding on the loan. On their daughter's birthday, they told her she no longer had to make payments.

Sam was Vice President of a very large corporation. As part of his fringe benefit package, the corporation purchased for him \(\$ 50,000\) of group-term life insurance. The corporation continues to pay for his life insurance even after retirement.

'The Morrises' three children gave their parents a gala retirement party. Many friends and relatives were invited. Gifts valued at over \(\$ 1,000\) were received by the couple.

\(\sqrt{ }\) In October, Mrs. Morris entered a contest being run by a local bank. She submitted drawings for a bank logo. Her drawing was selected and she received \(\$ 500\).

Many years ago, Sam purchased an annuity policy for \(\$ 9,000\). Starting on March 3, 2018, he began receiving lifelong monthly payments of \(\$ 60\). mult. 20.0 The Morrises' 21 -year-old daughter is in college. She worked during the summer and earned \(\$ 2,500\). Interest on her savings accounts amounted to \(\$ 500\). Her parents paid for the college tuition of \(\$ 4,000\).

\(\sqrt{\text { The Morrises have itemized deductions of }}\) \(\$ 20,000\).

Determine the Morrises' taxable income for 2018 .

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback