Consider the facts of problem 49. Assume that rather than property 1, Karen had received the accounts

Question:

Consider the facts of problem 49. Assume that rather than property 1, Karen had received the accounts receivable and $15,000 cash in complete liquidation of her interest in the partnership.

a. Would Section 751

(b) apply to the distribution?

b. How much gain will the partnership recognize in connection with the distribution?

c. What would be the character of the partnership’s gain (i.e., ordinary income or capital gain)?

problem 49

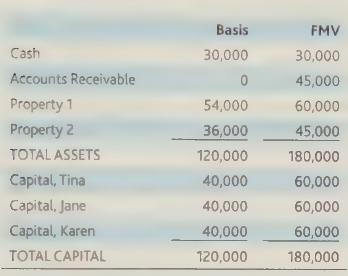

Challenge Partners had the following balance sheets at December 31:

On that date, it distributed Property 1 to Karen in complete liquidation of her interest in the partnership.

a. Will Section 751

(b) apply to this distribution?

b. Will Karen recognize any income or gain in connection with the distribution?

c. What will be Karen's tax basis in Property 1?

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback