Dave L. Jones, a calendar-year taxpayer using the cash method of accounting, was scared to death on

Question:

Dave L. Jones, a calendar-year taxpayer using the cash method of accounting, was scared to death on Halloween night, October 31, 2019.

Under the terms of the will, Dave devised and bequeathed all of the property he owned to his wife, Hildegard, except for a cash gift of $100,000 to the School of Accountancy at Louisiana Tech University, a condominium in Cancun, Mexico, to his beloved son, Billy Bob, a condominium in West Palm Beach, Florida, to Lee Ray Brown, and a

$20,000 cash gift to Peggy Sue Elmore (who befriended him late in life).

A review of the executor’s files and discussions with Mr. Jones's attorney reveal the following facts:

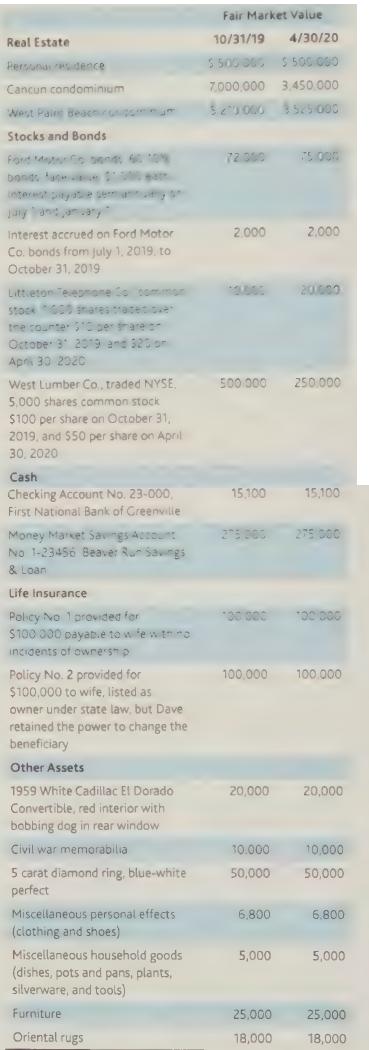

a. Mr. Jones's assets at (1) date of death and (2) six months later are as follows:

b. On November 7, 1976, Mr. Jones, pursuant to the legal firm’s suggestion of utilizing the annual exclusion and the specific exemption, gave $33,000 to his son Billy Bob. (Note that a $6,000 adjustment to the unified credit is required because of this transaction.)

c. Mr. Jones has made annual gifts of the exact annual exclusion amount to his son and each ofh is grandchildren each year (including 2019) since 1985. Other than these gifts and the one above, he made no gifts during his life.

d. Dividends of $2 per share were declared on the West Lumber Co. stock on October 1, 2019, but were not paid until November 15, 2019. Assume Mr.

Jones was alive on the date of record.

e. Interest of $6,500 accrued on the savings account at date of death.

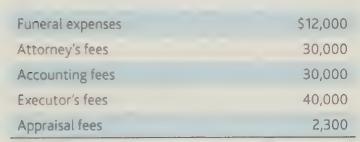

f. Fees:

g. Mortgage on personal residence, United Financial Mortgage Corp., 10 percent, $50,000.

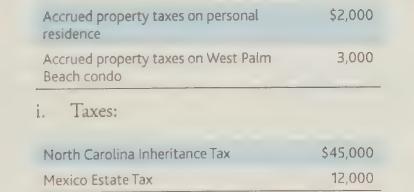

h. Debts:

j. A proviso in the will provided that the marital deduction for property passing to the wife shall not be reduced for death taxes, foreign death taxes, and funeral and administrative expenses.

k. The executor has decided to take all administrative expenses on the estate return.

l. Assume the executor elected to value the assets in the gross estate at their date of death values.

Required: Compute the net estate tax payable (note that the amount paid to Mexico is the amount of the foreign tax credit).

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback