Hucklebee Partners had the following balance sheets at December 31: Marci is a 40 partner in the

Question:

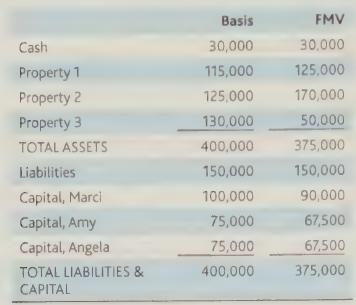

Hucklebee Partners had the following balance sheets at December 31:

Marci is a 40 partner in the partnership.

None of the partnership's assets constitute inventory or unrealized receivables. She is considering selling her interest in the partnership to Carla, an unrelated partner.

a. What is an appropriate selling price for Marci’s interest in the partnership?

b. Assume Marci and Carla agree on a selling price of $90,000. How much gain or loss will Marci recognize?

c. What will be Carla’s basis in her partnership interest?

Transcribed Image Text:

Cash Property 1 Property 2 Property 3 TOTAL ASSETS Liabilities Capital, Marci Capital, Amy Capital, Angela TOTAL LIABILITIES & CAPITAL Basis 30,000 115,000 125,000 130,000 400,000 150,000 100,000 75,000 75,000 400,000 FMV 30,000 125,000 170,000 50,000 375,000 150,000 90,000 67,500 67,500 375,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answer a To determine an appropriate selling price for Marcis interest in the partnership we need to ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Hucklebee Partners had the following balance sheets at December 31: Marci is a 40 partner in the partnership. None of the partnership's assets constitute inventory or unrealized receivables. She is...

-

Consider the facts in problem 57 above. Assume the partnership does not have a Section 754 election in effect, and decides not to make one. Shortly after the new buyer's acquisition of Jack's...

-

Bust-out Partners had the following balance sheets at year-end: On December 31, Jack sold his fifty percent interest in the partnership to an unrelated buyer for \(\$ 93,000\). None of the...

-

The Dulac Box plant produces 500 cypress packing boxes in two 10-hour shifts. What is the productivity of the plant?

-

Consider the following horizontal box plot: a. What is the median of the data set (approximately)? b. What are the upper and lower quartiles of the data set (approximately)? c. What is the inter...

-

Use the figure to determine the following. D 'G AC NAC

-

The Wide World of Fluids article titled "10 Tons on 8 psi,". A massive, precisely machined, 6-ft-diameter granite sphere rests on a 4-ft-diameter cylindrical pedestal as shown in Fig. P6.75. When the...

-

Two blocks, of masses m1 and m2, are connected to each other and to a central post by cords as shown in Fig, 5-37. They rotate about the post at a frequency f (revolutions per second) on a...

-

Prepare a physical unit flow reconciliation with the following information. Units of Blending Process Beginning work in process inventory Units started this period Product 182,000 390,000 Units...

-

Sowder Partners has the following balance sheets: Chris has been approached by an unrelated third party with an offer to purchase his interest in the partnership. a. What is the appropriate selling...

-

Assume the same facts as in problem 52, except that rather than sell his partnership interest to Susan, Woody receives a $47,000 cash distribution from the partnership in complete liquidation of his...

-

ELV Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced ELVs suppliers to lower...

-

Identify a true statement about skill. Multiple choice question. It is generally stable over time. It cannot be acquired through training. It is a learned talent that has been acquired by a person to...

-

Using Refactoring Miner to detect refactorings Description: The purpose of this assignment is to understand how to detect refactorings and design improvements, performed by developers as part of...

-

Patrick Ireland purchased a passenger automobile for his self-employed business on June 1, of the current tax year for $17,000. During the year, he uses the automobile 80 percent of the time for...

-

A call option on a single share of St. Margaret Beer Co.'s common stock has a market price of $7.02 and expires in six months. The option has an exercise, or strike, price of $68.00, and the current...

-

(15 pt.) A red and a blue die are thrown. Both dice are loaded (that is, not all sides are equally likely). Rolling a 2 with the red die is twice as likely as rolling each of the other five numbers...

-

Indicate which of the following transactions or events gives rise to the recognition of revenue in 2011 under the accrual basis of accounting. If revenue is not recognized, what account, if any, is...

-

A copper sphere of 10-mm diameter, initially at a prescribed elevated temperature T;, is quenched in a saturated (1 atm) water bath. Using the lumped capacitance method, estimate the time for the...

-

Corporation grants a nonqualified stock option to Penny, an employee, on January 1, 2016, that entitled Penny to acquire 1,000 shares of Bender stock at $80 per share. On this date, the stock has a...

-

Dan and Cheryl are married, file a joint return, and have no children. Dan, age 45, is a pharmaceutical salesman and Cheryl, age 42, is a nurse at a local hospital. Dans SSN is 400-20-1000 and...

-

Robert is a sole proprietor who uses the calendar year as his tax year. On July 20, 2016 he acquired and placed in service a business machine, a 7-year asset, for $50,000. No other property was...

-

If an organization has current assets of $120,000, total assets of $600,000, current liabilities of $60,000, long-term debt of $340,000, and total liabilities of $400,000, what is the current ratio?

-

An ice is encolsed in a cubical container of width W= 200 mm on a side, and the wall of the container is of thickness L= 5 mm and thermal conductivity k= 0.5 W/(mK). The inner surface of wall is at...

-

25.69 ... CP Two cylindrical cans with insulating sides and conducting end caps are filled with water, attached to the circuitry shown in Fig. P25.69, and used to determine salinity levels. The cans...

Study smarter with the SolutionInn App