In problem 66 above, what would be Susco's taxable income if the long-term capital gain were ($

Question:

In problem 66 above, what would be Susco's taxable income if the long-term capital gain were \(\$ 70,000\) (instead of \(\$ 40,000\) )?

problem 66

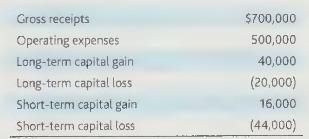

Susco had the following items this year:

What is Susco's taxable income and does it have any carrybacks/carryovers?

Transcribed Image Text:

Gross receipts Operating expenses Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss $700,000 500,000 40,000 (20,000) 16,000 (44,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

To calculate Suscos taxable income with a longterm capital gain of 70000 instead of 40000 we need to ...View the full answer

Answered By

Sarfraz gull

have strong entrepreneurial and analytical skills which ensure quality tutoring and mentoring in your international business and management disciplines. Over last 3 years, I have expertise in the areas of Financial Planning, Business Management, Accounting, Finance, Corporate Finance, International Business, Human Resource Management, Entrepreneurship, Marketing, E-commerce, Social Media Marketing, and Supply Chain Management.

Over the years, I have been working as a business tutor and mentor for more than 3 years. Apart from tutoring online I have rich experience of working in multinational. I have worked on business management to project management.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Lang Enterprises was started when it acquired $4,000 cash from creditors and $6,000 from owners. The company immediately purchased land that cost $9,000. Required a. Record the events under an...

-

The following data represent the selling price (in thousands of dollars) of oceanfront condominiums in Daytona Beach Shores, Florida. (a) Draw a boxplot of the data. Explain why a t-interval should...

-

Which of the following statements is not true? Explain why. A. A DNA strand can serve as a template strand on many occasions. B. Following semiconservative DNA replication, one strand is a newly made...

-

An immersion heater operating at \(1000 \mathrm{~W}\) is in the form of a rectangular solid with dimensions of \(16 \mathrm{~cm}\) by \(10 \mathrm{~cm}\) by \(1 \mathrm{~cm}\). Determine the heat...

-

For each of the aids used in the case, describe how they were constructed and if there were any modifications in form. MINI CASE Heublein, Inc., develops, manufactures, and markets consumer food and...

-

What is the total cash collection for April? Q1- the following is information of Royal Company for the quarter ending June 30th Sales budgets for the next four months are: April May June Budget sales...

-

Caskets Inc. was incorporated on June 1, but did not start business until September 1. It adopted a fiscal year ending March 31 , coinciding with the end of its natural business cycle. In connection...

-

Susco had the following items this year: What is Susco's taxable income and does it have any carrybacks/carryovers? Gross receipts Operating expenses Long-term capital gain Long-term capital loss...

-

Passengers died when a water taxi sank in Baltimore's Inner Harbor. Men are typically heavier than women and children, so when loading a water taxi, assume a worst-case scenario in which all...

-

Which of SWMs trading policies identified by the client are consistent with good trade governance? A. Only Policy 1 B. Only Policy 2 C. Both Policy 1 and Policy 2 Michelle Wong is a portfolio manager...

-

Calculate the delay cost incurred in trading the LIM order. Bradley also sees that following a 10 a.m. Federal Reserve press conference, the market rose significantly throughout that day. He wants to...

-

Which of Braggs responses regarding effective performance attribution is correct? A. Only Response 1 B. Only Response 2 C. Both Response 1 and Response 2 Alexandra Jones, a senior adviser at...

-

Identify two inappropriate themes in the partners set. Justify your response. Karen Swanson and Gabriel Russell recently co-founded Green Savanah Securities, an asset management firm conducting...

-

Which of the following qualitative considerations is most associated with determining whether investment manager selection will result in superior repeatable performance? A. Transparency B....

-

Experimental pressure-drop data obtained in a series of tests in which water was heated while flowing through an electrically heated tube of 0.527 in. ID, 38.6 in. long, are tabulated below...

-

Match the following. Answers may be used more than once: Measurement Method A. Amortized cost B. Equity method C. Acquisition method and consolidation D. Fair value method Reporting Method 1. Less...

-

Durra business is organized as a regular C corporation in 1986. At the beginning of the present year, Durra business elects to be an S corporation. Will the election cause a recapture of the general...

-

An S corporation may be subject to both the tax on built-in gains and the tax on excess passive income. Which tax is imposed first, and what effect does the imposition have on the other tax?

-

Distinguish between "net passive income" and "passive investment income" in the computation of the tax on excess net passive income of an S corporation.

-

A satellite is orbiting the earth, and is headed straight for a collision with another satellite on the same orbit. The satellite fires its jets backwards in order to slightly decrease its speed....

-

11. A block weighing 75 lbs. sits on an inclined plane where the coefficient of friction is 0.45. a. If the angle is 40.0, will the block slide down on its own? b. What would it take to drag the...

-

A washing machine produces disruptive noise during its spin cycle due to an uneven distribution of clothes around its circumference. To reduce the noise, an engineering consulting firm has proposed...

Study smarter with the SolutionInn App