Jean Kelley owned three limited partnership interests in 2018: How much is her passive loss deduction (against

Question:

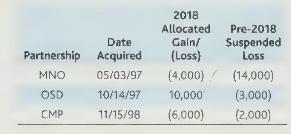

Jean Kelley owned three limited partnership interests in 2018:

How much is her passive loss deduction (against nonpassive activities) and suspended loss for each activity?

Transcribed Image Text:

2018 Allocated Date Gain/ Partnership Acquired (Loss) MNO 05/03/97 (4.000) OSD 10/14/97 10,000 CMP 11/15/98 (6,000) Pre-2018 Suspended Loss (14,000) (3,000) (2.000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

To calculate Jean Kelleys passive loss deduction and suspended loss for each limited partnership interest we need to consider the allocated gains or l...View the full answer

Answered By

Fazil P

I am a Civil Engineering Student. I am currently studying at NIT Calicut which is one of the best engineering colleges in India.I got in this college by cracking one of the toughest exam in India, JEE exam. I completed my Higher secondary education with an aggregate percentage of 98% . I completed matriculation with full A+.

I like to share my knowledge and I often helps my classmates in academics. I used to tutor high school students in their studies.

0.00

0 Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Jean Kelley owned three limited partnership interests in 2019: How much is her passive loss deduction (against nonpassive activities) and suspended loss for each activity? 2019 Allocated Pre-2019...

-

Tammy Faye Jones owned three passive activities in 2018 (she had no suspended losses prior to 2018): How much is her passive loss deduction (against nonpassive income) and suspended loss for each...

-

Tammy Faye Jones owned three passive activities in 2019 (she had no suspended losses prior to 2019): How much is her passive loss deduction (against nonpassive income) and suspended loss for each...

-

Apply normalization (1NF, 2NF and 3NF) of the system description given below and justify why relation needs 1NF, 2NF, and 3NF or not. At the end shift normalized data into Un-Normalized Data. S ystem...

-

Violent crimes include rape, robbery, assault, and homicide. The following is a summary of the violent-crime rate (violent crimes per 100,000 population) for all 50 states in the United States plus...

-

Which of the following is not a legal mechanism to recover assets through the civil or criminal justice systems? 1. Jury order 2. Freezing order 3. Judgment 4. Forfeiture

-

Responsibilities of an object define what they know and what they do. Provide an example for each.

-

Streams of methane and air (79 mole % N 2 , the balance O 2 ) are combined at the inlet of a combustion furnace pre-heater. The pressures of each stream are measured with open-end mercury manometers,...

-

dditional questions 1. Boris is a trader in fresh fruits. During June 2017, he reported sales of $120,000. His opening stock was $26,000 and purchases for the month was $114,000. Mark up is 50%. What...

-

Teri Frazier owned three businesses and rental properties in 2018. During the year, her hair salon business experienced a \(\$ 32,000\) net loss. She participated 200 hours in the hair salon...

-

Brent Fullback owned four passive activity interests in 2018: On March 2, 2018, Fullback sold his entire interest in A-1 for \(\$ 15,000\). His basis in the activity on January 1, 2018, was \(\$...

-

Over the past three years, Ice Scream has expanded its product offerings from basic chocolate and vanilla flavors to include many varieties of certified organic ice cream flavors. Ben Jerrie, founder...

-

The following figures relate to the retail business of A. Bell for the month of July 2016. Goods which are on sale fall into two categories, X and Y. You are to calculate for each category of goods:...

-

In a neighborhood of 95 homes, 35 have pets. Suppose that 12 homes are selected at random. The random variable X represents the number of homes in the sample that have pets. What is the probability...

-

J. Almeida is a trader who sells all of her goods at 40% above cost. Her books give the following information at 31 December 2017: You are required to: (a) Ascertain cost of goods sold. (b) Show the...

-

The trial balance as at 30 April 2014 of Timber Products Limited was balanced by the inclusion of the following debit balance: Difference on trial balance suspense account 2,513. Subsequent...

-

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zerocoupon...

-

Find the optimal dimensions for a heated cylindrical tank designed to hold 10 m3 of fluid. The ends and sides cost $200/m2 and $100/m2, respectively. In addition, a coating is applied to the entire...

-

What are technical skills At what level are they most important and why?

-

What is the applicable credit amount?

-

What is a domestic corporation?

-

Why can't a partner recognize loss upon receipt of a current distribution?

-

Help me: his business sells products for local artisans using Square POS. Sales transactions debit Cash and credit Vendors Payable. When paying vendors, they debit Vendors Payable and credit Cash....

-

Use Taylor series expansion to obtain an expression for (a) f(x) = ex cosx, 24. Compute the following limits: (b) f(x) = sin x.

-

(a) Consider the sequence {F} defined by F = 1, F2 = 1 and Fn+2 Show that = Fn (b) Find the limit of the ratio Fn+1 Fn n (1 + 5) (1 5) 2n5 = Fn+1 + Fn.

Study smarter with the SolutionInn App