Joe Quick and Jane Reddy are equal partners in the Quick and Reddy partnership. On the first

Question:

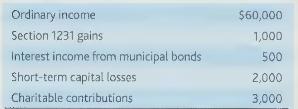

Joe Quick and Jane Reddy are equal partners in the Quick and Reddy partnership. On the first day of the current taxable year, Joe's adjusted basis in his partnership interest is \(\$ 10,000\) and Jane's adjusted basis is \(\$ 2,000\). During the year, Joe had withdrawals of \(\$ 25,000\) and Jane had withdrawals of \(\$ 20,000\). Given the following partnership activity for the year, determine each partner's adjusted basis in Quick and Reddy at the end of the taxable year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: