KJJ Corp. was formed on October 10, 2002 by Kimberly Jen (123-45-6789), Jennifer James (234-56- 7890) and

Question:

KJJ Corp. was formed on October 10, 2002 by Kimberly Jen

(123-45-6789), Jennifer James (234-56-

7890) and James Kim (345-67-8901). It is a hardware store and is located at 175 Clerk Road, Newtown, OH 45105. KJJ’s employer identification number is 10-1010101 and its business code is 444130. K]J]’s telephone number is 513-525-1234 and its e-mail address is K//Corp @kjj.com.

KJJ Corp. uses the calendar year and the accrual basis. It uses straight-line depreciation for tax and book purposes and FIFO and lower-of-cost-or-market for inventory purposes.

Kimberly, Jennifer and James each received 200 shares of KJJ Corp.’s common stock on October 10, 2002. No other stock has been issued or is outstanding. Each is a fulltime employee of the firm and each is paid $200,000.

K]JJ Corp. made a $105,000 ($35,000 to each owner) cash distribution in 2018.

During 2018, KJ] Corp. made estimated federal tax payments of $55,000 each quarter.

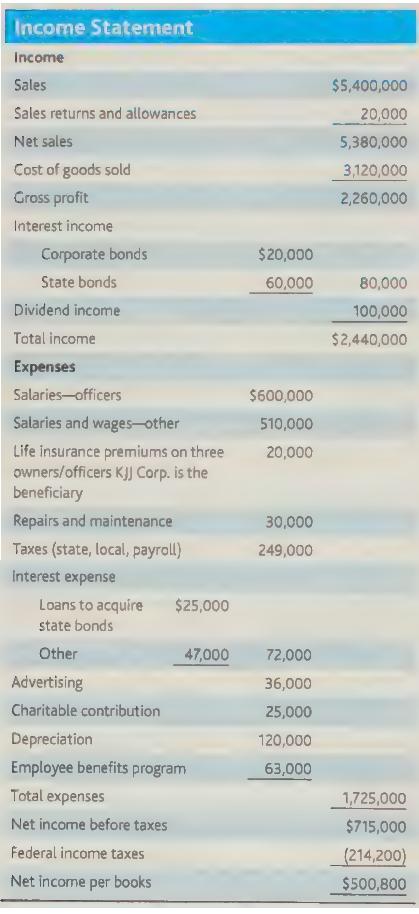

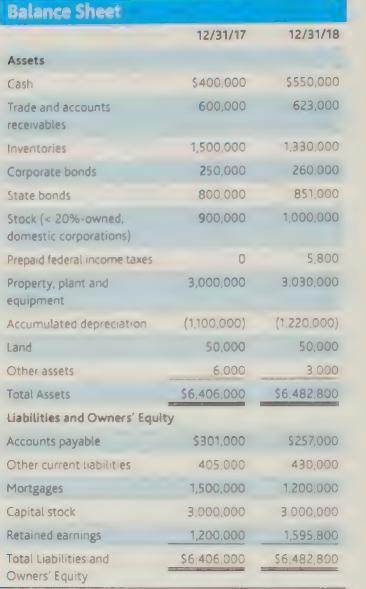

Financial information for 2018 follows:

Prepare KJJ Corp.'s From 1120 and related schedules/forms: Forms 1125-A and 1125-

E, and Schedules C, J, K, L, M-1, and M-2.

(Do not complete Form 4562 [depreciation calculation] since you do not have all the information). Go to www.irs.gov and download the necessary forms.

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback