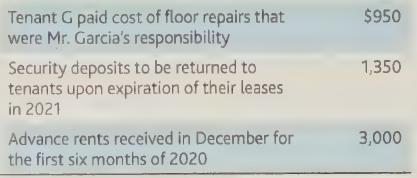

Mr. Garcia, a cash-basis taxpayer, owns an apartment building. His records reflect the following information for 2019:

Question:

Mr. Garcia, a cash-basis taxpayer, owns an apartment building. His records reflect the following information for 2019:

What is the amount of gross rental income Mr. Garcia should include in his gross income?

a. $2,300

b. $3,000

c. $3,950

d. $4,350

e. $5,300

Transcribed Image Text:

Tenant G paid cost of floor repairs that were Mr. Garcia's responsibility Security deposits to be returned to tenants upon expiration of their leases in 2021 Advance rents received in December for the first six months of 2020 $950 1,350 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

ANSWER The correct answer is b 3000 For a cashbasis taxpayer like Mr Garcia rental income is gen...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Baldev is a CPA and sole practitioner. He started the practice five years ago and has managed to make enough from it to support his family. However, just over one-half of his income comes from a...

-

A thermocouple Type K is calibrated in lab condition at 50% relative humidity (RH) prior to outdoor operation. After 12-month in outdoor installation, the thermocouple is again tested at 75% RH. Both...

-

Mrs. Roberts, in a diabetic coma, has just been admitted to Noble Hospital. Her blood pH indicates that she is in severe acidosis (low blood pH), and measures are quickly instituted to bring her...

-

In Exercises 1 through 22, find the critical points of the given functions and classify each as a relative maximum, a relative minimum, or a saddle point. f(x, y) = xy 2 6x 2 3y 2

-

Who is often recognized as being the first hospital administrator and what major contributions did she make to nursing and the improvement of patient care?

-

During the year ended 30 June 2016, Beautiful Bottles Pty Ltd incurred the following costs in connection with its production activities. Raw materials purchases Factory electricity Indirect labour...

-

For 2016, Theta Corporation had net income of $2,250,000. At the beginning of the year, there were 800,000 shares outstanding, and halfway through the year the company issued 130,000 new shares. If...

-

Joe signed for a ten-year lease to rent office space from Stanley. In the first year, Joe paid Stanley $5,000 for the first years rent and $5,000 as rent for the last year oft he lease How much must...

-

Faraway Travel, Inc. granted its vice-president, Chris Best, an incentive stock option on 1,000 shares of Faraway stock at $25 a share, its fair market value, on July 22, Year 1. Chris exercised the...

-

Pauls Painters, a service organization, prepared the following special report for the month of January 2015: Required: 1. The owner (who knows little about the financial part of the business) asked...

-

You are asked to value an investment opportunity. You are given a required rate of return of 12.75% APR compounded quarterly. However, the investment makes semiannual payments. You need a required...

-

P&G and the market have the following annual returns. The risk-free rate is 3.5% and the equity market risk premium is 7.7%. Using CAPM and the data provided, what is P&G's expected return? Write...

-

What is the largest global deal during the quarter covered by the latest PwC report? What were the elements of this deal (company, location, industry, dollar value of the deal, VC investors involved)?

-

Your newborn child will need $100,000 for college expenses in 18 years. If the maximum you can save every month is $350, what annual rate of return must you earn on your investments to reach this...

-

You like high dividend stocks and took note when we looked at Verizon in class this quarter. You see its the balance sheet and income statement below. Develop the managerial balance sheet and income...

-

The company intends to issue 20-year bonds with a face value of $1,000. The bonds carry a coupon rate of 9%, and interest is paid semiannually. On the issue date, the market interest rate for bonds...

-

What is the mode?

-

Assume the same facts as in Problem 36, except that the two shareholders consent to an AAA bypass election.

-

At the beginning of the tax year, Lizzie holds a $10,000 stock basis as the sole shareholder of Spike, Inc., an S corporation. During the year, Spike reports the following. Determine Lizzies stock...

-

Assume the same facts as in Problem 38, except that the cash distribution to Lizzie amounts to $40,000. Determine Lizzies stock basis at the end of the year, and the treatment of her cash...

-

How to calculate the average precision (AP) for each adopted query and the mean average precision (MAP), based on both arithmetic and geometric means, must be calculated in terms of interpolated...

-

Using the relative contribution of the B to the overall expected portfolio return, show whether index leverage or single-stock leverage results in better leverage for a portfolio manager who is good...

-

Can social norms be understood as emergent properties of social interactions, reflecting negotiated agreements among members of a society regarding acceptable behavior and moral standards?

Study smarter with the SolutionInn App